By: Russ Kamp, CEO, Ryan ALM, Inc.

My recollection of the 1970s has more to do with playing high school sports, graduating from PPHS in 1977, and then going off to Fordham where I would meet my wife in an economics class in 1979. I wasn’t really focused on the economy throughout much of the decade. You see, college was reasonably affordable, and gas and tolls (GWB) were not priced outrageously, so getting back and forth to the Bronx wasn’t crushing for me and my parents.

However, I do recall the two oil embargoes that rocked the economy during the decade. I vividly recall the 1973 oil embargo that was triggered by the Yom Kippur War. I was a newspaper delivery boy for the Hudson Dispatch and was frequently amazed by the long gas lines that would stretch for blocks on both odd and even days, as I drove by on my bike. The Organization of Arab Petroleum Exporting Countries instituted the oil embargo against any country supporting Israel, including the U.S. This led to a dramatic increase in oil prices from about $3/barrel to roughly $12/barrel. This action led to widespread economic disruption, and as you can imagine, significant inflationary pressures.

The 1979 oil crisis was precipitated by the Iranian Revolution which saw the overthrow of the Shah of Iran in February 1979. The Revolution created a significant disruption in oil production in Iran, causing global oil supply issues. Similarly, to the 1973 crisis, oil prices surged from about $14/barrel to nearly $40/barrel. Once again, gasoline shortages materialized and inflation rose rather dramatically. This oil impact would lead to a period of economic stagnation that would eventually be defined as “stagflation”.

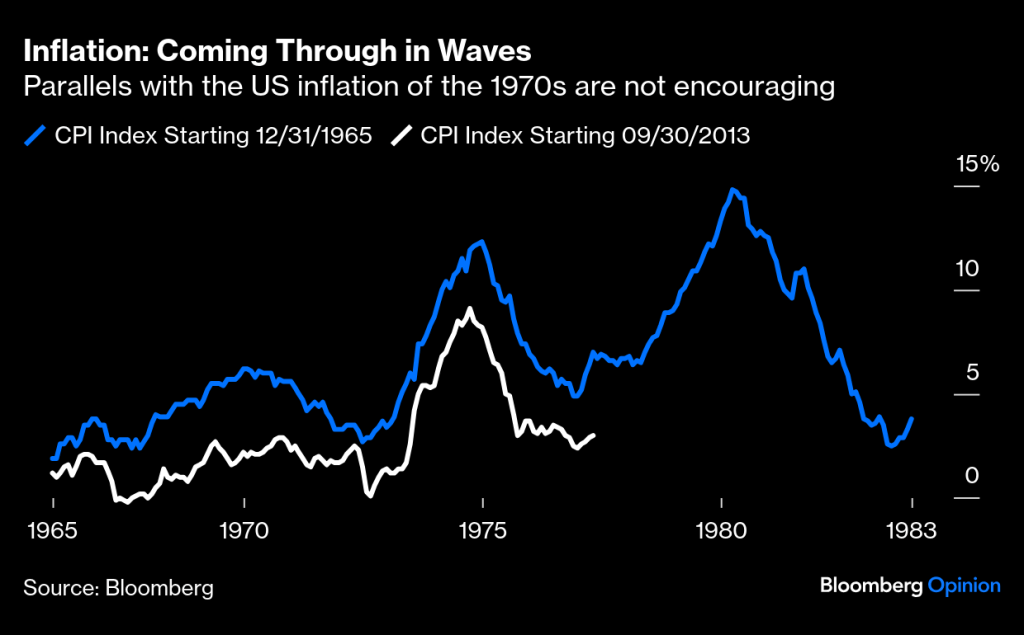

Now, I am NOT saying that we are about to face significant oil embargoes. But I am reminding everyone that history does have a tendency to repeat itself even if the players aren’t exactly the same. The graph below is pretty eye-opening, at least to me.

For those of you who can recall the 1970s, you’ll remember that the US Federal Reserve tried to mitigate inflation through aggressive increases in the Fed Funds Rate, which would eventually hit 20% in March 1980. As a result of their action, U.S. Treasury yields rose dramatically, too. For instance, the yield on the US 10-year Treasury note would peak at 15.84% in September 1981. As an FYI, I would enter our industry in October 1981.

Despite the aggressive action by the Fed’s FOMC beginning in March 2022, inflation has not been brought under control. Were they premature in reducing the FFR 3 times and by 1% to end 2024? A case could certainly be made that they were. So, where do we go from here? There certainly appears to be some warning signs that inflation could raise its ugly head once more. We are in the midst of a rebound in food inflation, and not just eggs. I just read this morning that those heating with natural gas will see about a 10% increase in their bills relative to last year – ouch. There are other worrying signs as well without even getting into the potential impact from policy changes brought about by the new administration.

It is quite doubtful that we will witness peaks in inflation and interest rates described above, but who really knows? Given the great uncertainty, and the potentially significant ramifications of a renewed inflationary cycle (2022 was not that long ago), plan sponsors should be working diligently to secure the current funding levels for their plans. Why continue to subject all of the assets to the whims of the markets for which they have no control over? Inflationary concerns rocked both the equity and bond markets in 2022. In fact, the BB Aggregate Index suffered its worst loss (-13%) by more than 4X the previous worst annual return (-2.9% in 1994). Rising rates crush traditional core fixed income strategies, but they are a beautiful benefit when matching asset cash flows (principal and interest) to liability cash flows (benefits and expenses) through CFM.

As a plan sponsor, I’d want to find as much certainty as possible, given the abundant uncertainty of markets each and every day. As Milliman has reported, both private and public pension funded ratios are at levels not seen in years. Don’t blow it now!