By: Russ Kamp, CEO, Ryan ALM, Inc.

If it is a Monday, it is ARPA/SFA update day. I’m bringing you this update from Fort Lauderdale, FL, where I’m attending and speaking at the NCPERS Fall conference. It looks like a wonderful agenda for the next few days. Regarding ARPA, how did the PBGC do last week? Let’s explore.

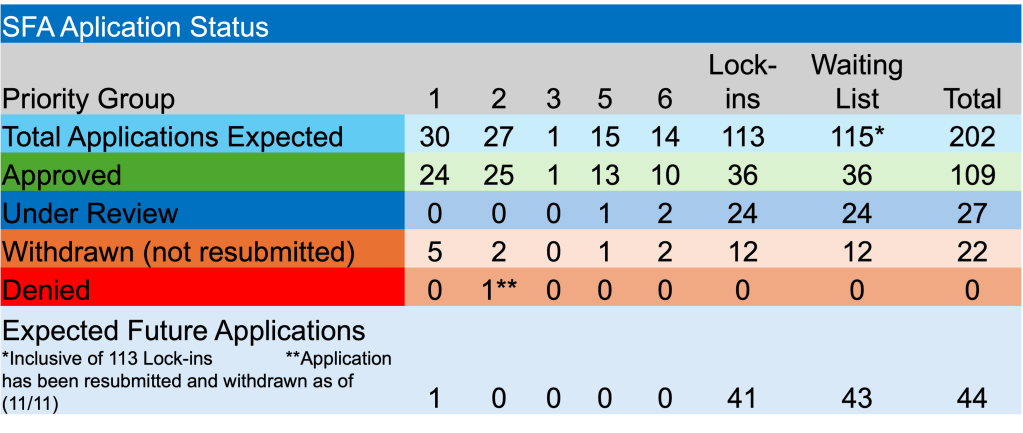

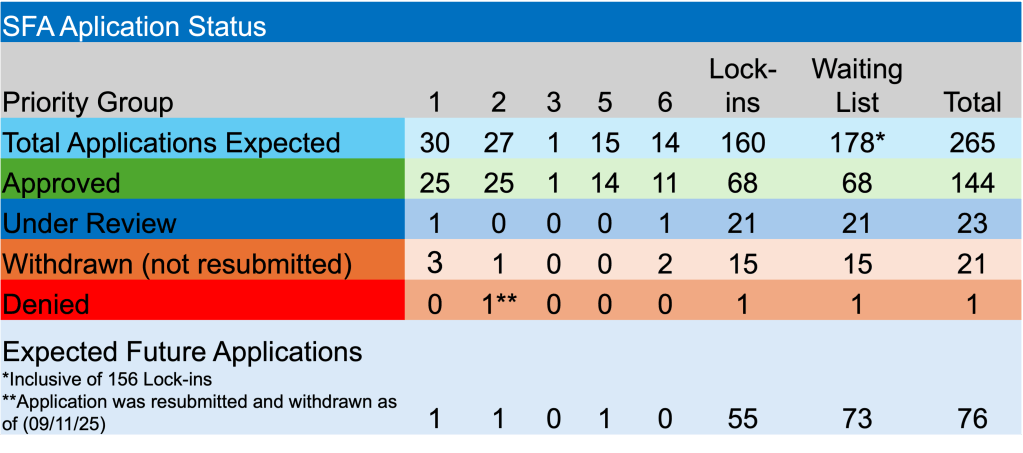

Last week saw limited action with only two applications received, including a revised application from a Priority Group 1 member. As you may recall, this was the first group permitted to submit applications all the way back in July 2021! Only 25 of the 30 members of that cohort have received Special Financial Assistance to date. Richmond, VA based Bricklayers Union Local No. 1 Pension Fund of Virginia, submitted a revised application seeking $12.9 million for its 395 participants, while International Association of Bridge, Structural, Ornamental and Reinforcing Ironworkers Local No. 79 Pension Fund, submitted an initial application hoping to secure $14.6 for 462 members. As an aside, the Ironworkers would be golden if the SFA desired was based on the length of the plan’s name.

In other ARPA news, or lack thereof, there were no applications approved, and fortunately, none denied. There were no pension plans forced to withdraw an application and none asked to repay a portion of the SFA received due to census errors. However, there was one more plan added to the burgeoning waitlist. The Soft Drink Industry Pension Fund is the 178th none-priority group fund to add its name to the list.

The next couple of months should be quite exciting for the PBGC as it works through the abundant list of applications for non-priority group members. U.S. interest rates have pulled back recently reducing some of the potential coverage period through a CFM strategy, but rates are still significantly higher than they were in 2021 when ARPA began to be implemented. Please reach out to us if you’d like to get a free analysis on what is possible once the SFA is received.