By: Russ Kamp, Managing Director, Ryan ALM, Inc.

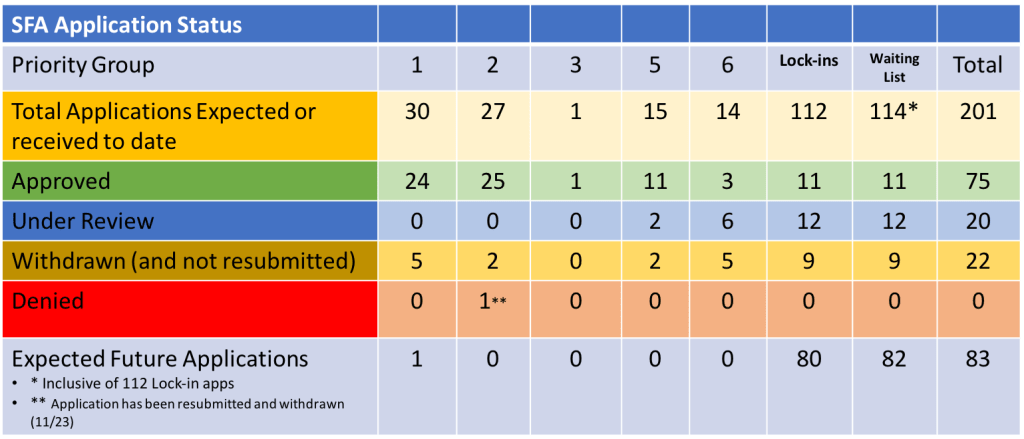

Cash Flow Matching (CFM) has enjoyed a renaissance within the pension community since US interest rates began rising in March 2022. The expanded use has not been limited to the beneficiaries of the Special Financial Assistance (SFA) paid through grants as a result of the ARPA pension reform being passed in March 2021. As a reminder, SFA proceeds are to be used exclusively to fund benefits (and expenses) as far into the future as the allocation will go. Protecting the precious grant proceeds has led to multiemployer pension plan sponsors and their advisors mostly using the 67+% in fixed income in defeasement strategies. We, at Ryan ALM, have certainly benefitted from this trend and applaud them for this decision.

In addition to multiemployer plans, both public and private (corporate) pension plans, as well as E&Fs have used CFM to bring an element of cash flow certainty (barring any defaults) to the management of pension assets and the generation of liquidity without being forced to sell assets, which can be very painful during periods of great uncertainty/volatility. These entities join insurance companies and lottery systems that have engaged in CFM activities for decades.

However, there remains a belief that CFM strategies only work during periods of high interest rates. We disagree, since liquidity is needed on a continuous basis. We believe that the use of CFM should be dictated by a number of factors, such as the entities funded status, ability to contribute, and the current fixed income exposure, as well as those liquidity needs. Unfortunately, it appears that interest rates have peaked for the time being. During the Summer of 2023, we were constructing CFM portfolios with a 6+% YTW, capturing most of the average ROA with little volatility. It was a wonderful scenario that unfortunately was not taken advantage of by most sponsors.

Today we are still able to build through our investment grade corporate bond focus portfolios with a YTW around 4.6%. Given the aggressive move down in Treasury yields during the last few months, we think that bond investors have gotten ahead of the Fed at this point as they are discounting about 150 bps of Fed rate cutting. Despite progress in the inflation fight, “sticky” inflation remains in excess of 4%. The US labor market’s unemployment rate is only 4.2%. Wage growth remains above 4%, while initial jobless claims remain at modest levels. Furthermore, the Atlanta Fed’s GDPNow model is forecasting growth for Q3’24 at 3.0% as of September 17, 2024. None of these metrics signal recession to me. How about you?

If you are of the mindset that a 4.6% YTW isn’t providing you with enough return, just think what you’d get from traditional active fixed income portfolios should rates rise once more. Please remember 2022’s -13% total return for the BB Aggregate Index. We frequently write about the need for plan sponsors to think outside the box as it relates to the allocation of assets. We believe that your plan’s assets should be bifurcated into two buckets – liquidity and growth. While the CFM portfolio is providing your plan with the necessary liquidity on a monthly basis, the growth assets can now grow unencumbered. These assets will be used at a later date to meet future benefits and expenses. With a CFM portfolio, plan sponsors can reduce or eliminate the need to do a “cash sweep” that takes away reinvestment in the growth portfolio.

In addition to believing that CFM is still a viable strategy in this environment, the decline in US Treasury yields is once again opening a door for sponsors to consider a pension obligation bond (POB). The 10-year Treasury Note yield is only 3.66% as of 6 pm EST (9/17) or roughly slightly more than half of the average public fund ROA. Estimates place the average funded ratio for public plans at 80%. For a plan striving for 7%, an 8.4% annual return must be created, or the plan’s funded status will continue to deteriorate unless contributions are increased to offset the shortfall. For plans that have funded ratios below the “average” plan, it is imperative that the deficit is closed more quickly. Issuing a POB and using the proceeds to close that gap is a very effective strategy. Corporate plans frequently issue debt and use the proceeds for a number of purposes, including the funding of pension funds.

We’d recommend once again that the proceeds received from a POB be used in a defeasement strategy to meet current liquidity needs and not invested in a traditional asset allocation framework with all of the uncertainty that comes from investing in our capital markets. Why risk potential losses on those assets when a CFM strategy can secure the Retired Lives Liability? It is truly unfortunate that most plan sponsors with underfunded plans didn’t take advantage of the historically low interest rates in 2020 and 2021. Cheap money was available for the taking. It is also unfortunate, that those plans that did take advantage of the rate environment likely invested those proceeds into the existing asset allocation. As you might recall, not only did the BB Aggregate decline -13% in 2022, the S&P 500 fell -18% that year, too.

Managing a DB pension plan comes with a lot of uncertainty. At Ryan ALM, we are trying to bring investment strategies to your attention that will provide certainty of cash flows, which will help stabilize the fund’s contributions and funded status. Don’t be the victim of big shifts in US interest rate policy. Use bonds for their cash flows and secure the promises for which your plan exists in the first place. A defeasment strategy mitigates interest rate risk because the promises (benefits and expenses) are future values, which are not interest rate sensitive. That should be quite comforting. Let us know how we can help you. We stand ready to roll.