By: Russ Kamp, CEO, Ryan ALM, Inc.

Milliman has once again released its monthly Milliman 100 Pension Funding Index (PFI), which analyzes the 100 largest U.S. corporate pension plans, and the news continues to be quite good.

Market appreciation of 1.05% during January lifted the market value of PFI plan assets by $8 billion increasing total AUM to $1.327 trillion. A slight 1 bp rise in the discount rate to 5.47% lowered plan liabilities marginally to $1.217 trillion at the end of January. As a result, the PFI funded ratio climbed from 108.2% at the beginning of the year to 109.0% as of January 31, 2026.

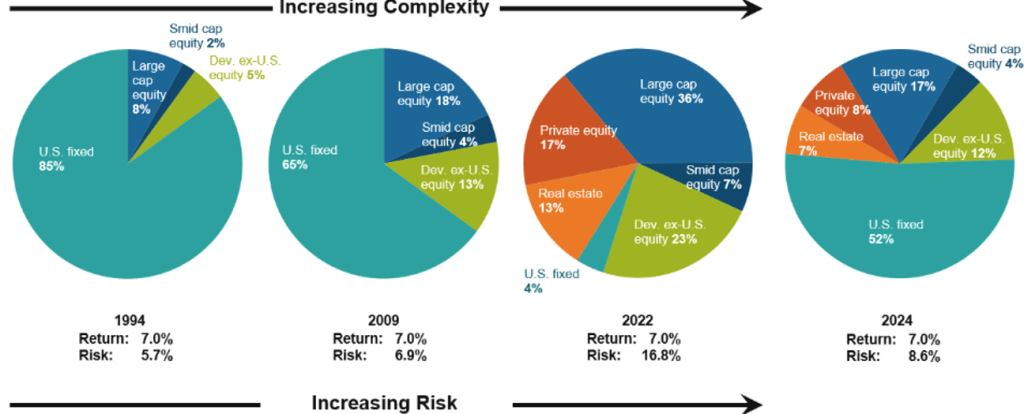

“January’s strong returns contributed $8 billion to the PFI plans’ funding surplus, while declining liabilities contributed another $2 billion,” said Zorast Wadia, author of the Milliman 100 PFI. “Although funded ratios have now improved for 10 straight months, managing this surplus will continue to be a central theme for many plan sponsors as they employ asset-liability matching strategies going forward.” We couldn’t agree more, Zorast! Given significant uncertainty regarding the economy, inflation, interest rates, and geopolitical events, now is the time to modify plan asset allocations by reducing risk through a cash flow matching strategy (CFM).

CFM will secure the promised benefits, provide the necessary monthly liquidity, extend the investing horizon for the non-CFM assets, while stabilizing the funded status and contribution expenses. Corporate plan sponsors have worked diligently tom improve funding and markets have cooperated in this effort. Now is not the time to “let it ride”. Ryan ALM will provide a free analysis to any plan sponsor that would like to see how CFM can help them accomplish all that I mentioned above. Don’t be shy!

Click on the link below for a look at Milliman’s January funding report.

View this month’s complete Pension Funding Index.

For more on Ryan ALM, Inc.