By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Managing a pension plan should be all about securing the promised benefits at a reasonable cost and with prudent risk. I believe that most plan sponsors would agree, yet that is not how plans are managed, especially public and multiemployer plans that continue to pursue the return on asset assumption (ROA) as if it were the Holy Grail. I’ve written quite a bit on this subject, including discussing asset consulting reports that should have the relationship of plan assets to plan liabilities on page one of the quarterly performance reports.

We know that pension liabilities are like snowflakes, as there are no two pension liability streams that are the same given the unique characteristics of each labor force. Furthermore, most pension actuaries only produce an annual update making more frequent (monthly/quarterly) updates more challenging. Would plan sponsors want a more frequent view of the liabilities if they were available? I think that they would. Again, if securing the promised benefits are the primary objective when it comes to managing a pension plan, then plan sponsors need a more frequent view of the relationship between assets and liabilities.

Why is this important? First and foremost, the capital markets are constantly moving, and the changes impact the value of the plan’s assets all the time. But it isn’t just the asset-side that is being impacted, as liabilities are bond-like in nature and they change as interest rates change. We’ve highlighted this activity in both the Ryan ALM Pension Monitor and the Ryan ALM Quarterly Newsletter. However, accounting rules for both multiemployer and public plans allow a static discount rate equivalent to the plan’s ROA to be used that hides the impact of those changing interest rates on the value of a plan’s liabilities and funded status.

What if a more frequent analysis was available at a modest cost. Would plan sponsors want to see how the funded status was behaving? Would they want that comparison available to help with asset allocation changes, especially if it meant reducing risk as funding improved? I suspect that they would. Well, there is good news. Ryan ALM, Inc. created a Custom Liability Index (CLI) in 1991. The CLI is designed to be the proper benchmark for liability driven objectives. The CLI calculates the present value of liabilities based on numerous discount rates (ASC 715 (FAS 158), PPA – MAP 21, PPA – Spot Rates, GASB 67, Treasury STRIPS and the ROA). The CLI calculates the growth rate, summary statistics, and interest rate sensitivity as a series of monthly or quarterly reports depending on the client’s desired frequency.

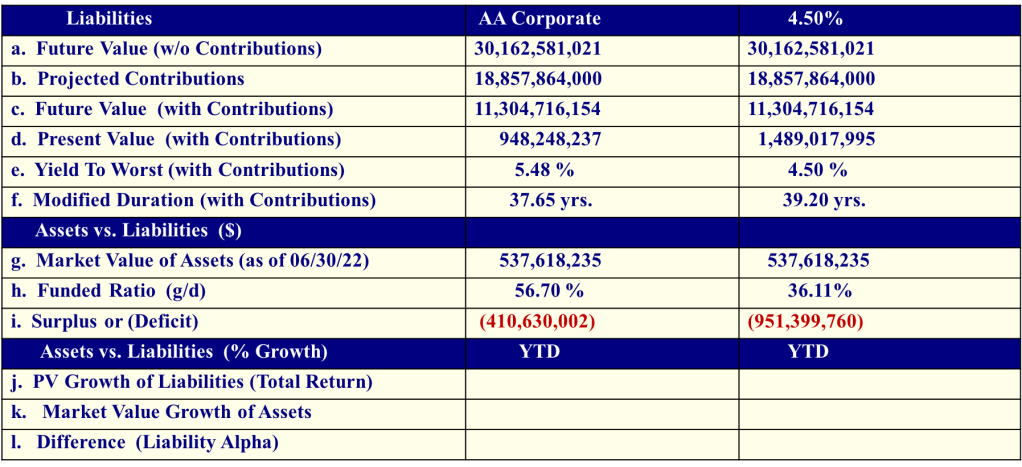

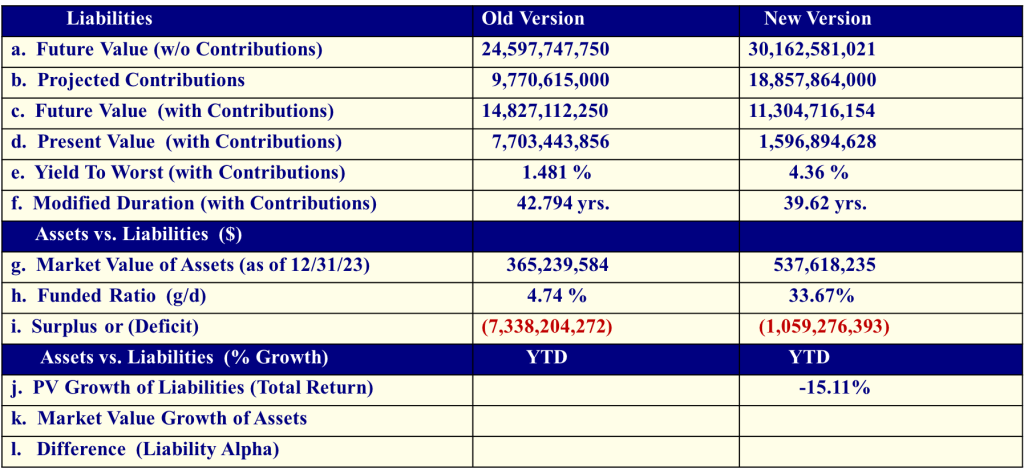

The above information is for an actual client, who we’ve been providing a CLI for 15+ years. This client has elected to receive quarterly reviews. They’ve also chosen to see the impact on liabilities for multiple discount rates, including a constant 4.5% ROA, which could easily be a pension plan’s ROA of say 7%. As you will note, the present value (PV) of those future value (FV) liabilities are different, and they could be dramatic, depending on the interest rate used. In this case, the AA Corporate rate (5.48% YTW) produces a funded ratio of 56.7%, while the flat 4.5% rate increases the PV liabilities thus reducing the funded status by more than 20%.

Using Treasury STRIPS as the discount rate produces the lowest funded ratio of 33.7% or 23% lower than using the AA Corporate discount rate.

With this information, plan sponsors and their advisors (consultants and actuaries) can make informed decisions related to contributions and asset allocation. Most plan sponsors are currently blind to these facts. As a result, decisions may be taken without having all of the necessary facts. Pension plans need to be protected and preserved (Ryan ALM’s mission). Having a complete understanding of what those future promises look like is essential.

You’ve made a promise: measure it – monitor it – manage it – and SECURE it…

Get off the pension funding rollercoaster – sleep well!