By: Russ Kamp, Managing Director, Ryan ALM, Inc.

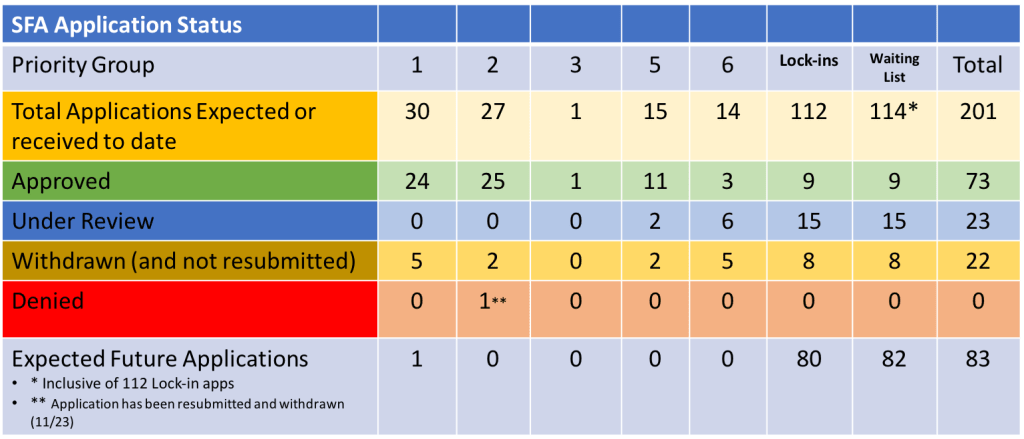

Welcome to June and the latest update on the PBGC’s effort to implement the ARPA pension legislation. There isn’t much to report, but I’m happy to mention that two plans received approval of the SFA applications.

Maryland Race Track Employees Pension Plan and the Radio, Television and Recording Arts Pension Plan were granted approval for SFA totaling $89.6 million. Both plans were categorized as non-priority funds. In the case of the Maryland Race Trace Employees, they are galloping toward receiving $26.7 million for the 1,407 plan participants, while the Radio, Television and Recording Arts will no longer have to perform for their benefits as they will get $62.8 million for the plan’s 516 participants or roughly $121 K per participant.

The only other reported activity had the Carpenters Pension Trust Fund – Detroit & Vicinity pulling its application that was seeking $595.5 for more than 22,000 members of the plan. This non-priority plan from Troy, MI, pulled its initial application. There were no new applications filed or rejected. No plans were added to the waitlist and no pension funds returned excess SFA assets.

June looks to be shaping up as a busy month for the PBGC, as there are nine funds that have approval dates this month, including the Bakery and Confectionery Union and Industry International Pension Fund, that is seeking nearly $3.2 billion in SFA. In total, the nine funds are hoping to gather more than $6 billion in grants for 233,845 participants. Six of the nine funds are waiting to get approval from the PBGC on revised applications. Good luck.