By: Russ Kamp, CEO, Ryan ALM, Inc.

We hope that you enjoyed a fabulous Thanksgiving holiday with your family and friends. This update is the last one for November. Wow, that month went by quickly.

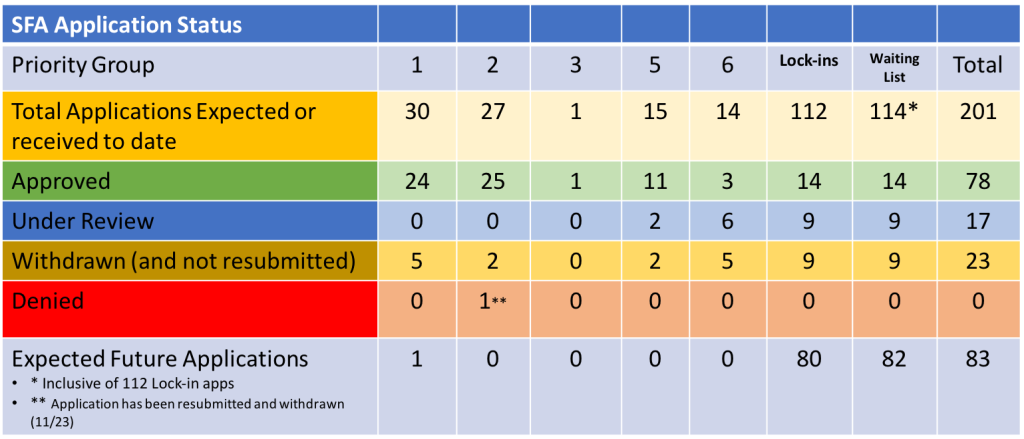

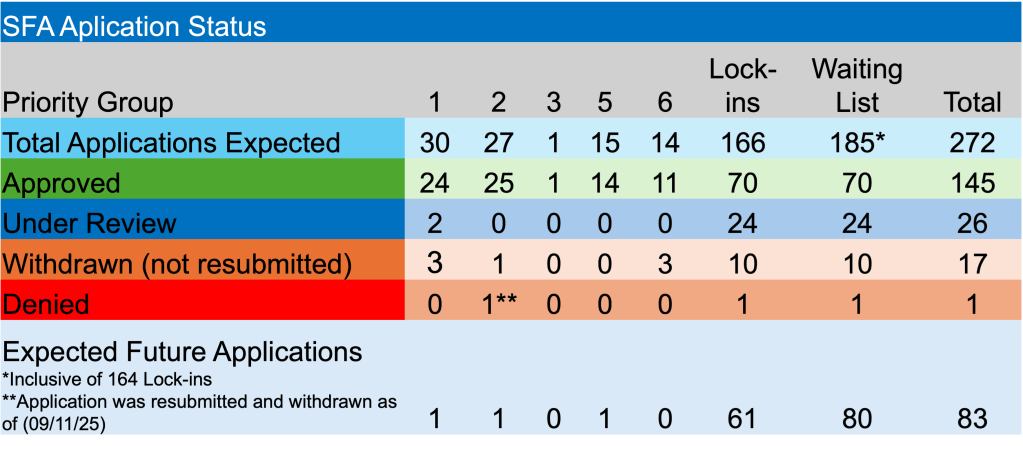

Regarding the ARPA legislation, have we entered the last month for new applications to be received by the PBGC? As I’ve mentioned multiple times, the ARPA pension legislation specifically states that initial applications must be submitted to the PBGC by 12/31/25. Revised applications can be submitted through 12/31/26. If this is the case, we have roughly 83 applications yet to be submitted. Compounding this issue is the fact that the PBGC’s e-Filing portal is temporarily closed.

The PBGC’s recorded activity was light last week which shouldn’t surprise anyone given the holiday last week. There were no applications received, denied, or withdrawn. Furthermore, there were no recipients of Special Financial Assistance (SFA) requested to rebate a portion of the grant payment due to census issues. Thankfully, it has been more than two months since we last had a plan pay back a small percentage of the proceeds.

There was some good news, as Exhibition Employees Local 829 Pension Fund, a non-priority group member, received approval of its initial application. The fund will receive $14.2 million in SFA for the 242 plan participants. This pension plan became the 70th non-priority plan to receive SFA and the 145th overall. To-date, $72.8 billion in SFA grants have been awarded!

Despite the near unanimity by market participants that U.S. Treasury yields will fall as the Fed’s FOMC prepares another Fed Funds Rate cut, interest rates are rising today. The current level of Treasury yields and bonds that price off that curve are still providing SFA recipients with attractive rates in which to secure the promised benefits through a cash flow matching (CFM) strategy. Don’t subject the SFA to the whims of the markets, especially given so much uncertainty and currently high valuations.