By: Russ Kamp, Managing Director, Ryan ALM, Inc.

The Fed’s meeting notes from the September 17-18 FOMC have recently been released. Here are a few tidbits:

Some officials warned against lowering rates “too late or too little” because this risked harming the labor market.

At the same time, other officials said cutting “too soon or too much” might stall or reverse progress on inflation.

Here’s my favorite:

Officials also don’t seem in agreement over how much downward pressure the current level of the Fed’s benchmark rate was putting on demand.

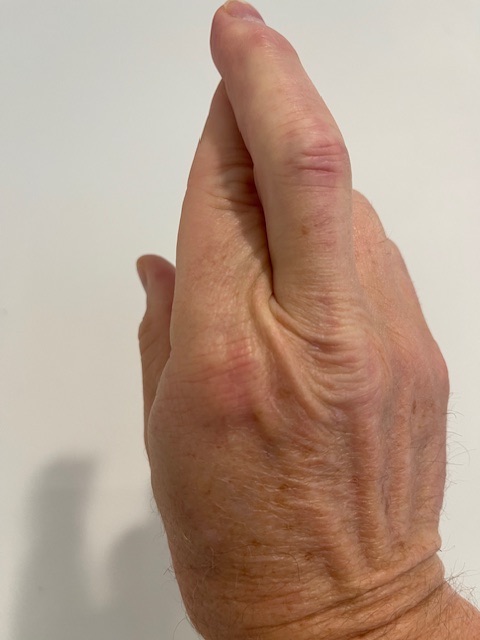

I have an idea, why don’t we just have each member of the Federal Reserve’s board of governors stick their finger in the air and see which way the economic winds are blowing. It may be just as effective as what we currently seem to be getting.

Given that the economy continues to hum along with annual GDP growth of roughly 3% and “full employment” at 4.1%, I’d suggest that having a Fed Funds Rate at 5.25%-5.50% wasn’t too constraining, if constraining at all. We’ve highlighted in this blog on many occasions the fact that US rates had been historically higher for extended periods in which both the economy and markets (equities) performed exceptionally well – see the 1990’s as one example.

Furthermore, as we’ve also highlighted, there is a conflict between current fiscal and monetary policy, as the fiscal 2024 federal deficit came in at $1.8 trillion or about $400 billion greater than the anticipated deficit at the beginning of the year. That $400 billion is significant extra stimulus that leads directly to greater demand for goods and services. How likely is it that the fiscal deficit for 2025 will be any smaller?

I believe that there are many more uncertainties that could lead to higher inflation. The geopolitical risks that reside on multiple fronts seem to have been buried at this time. Any one of those conflicts – Russia/Ukraine, Israel/rest of the Middle East, and China/Taiwan – could produce inflationary pressures, even if it just results in the US increasing the federal budget deficit to support our allies.

If just sticking one’s finger in the air doesn’t help us solve our current confusion, there is always this strategy: