By: Russ Kamp, CEO, Ryan ALM, Inc.

We’ve already shared with you the importance of dividends to the long-term return of the S&P 500 by referencing studies conducted by Guinness Global Investors.

According to the Guinness study, which was last updated as of April 2020, the contribution to return of the S&P 500 from dividends and dividends reinvested for 10-year periods since 1940 was a robust 47% down insignificantly from 48% a decade ago. Extending the measurement period to 20 years from 1940 forward highlights an incredible 57% contribution to the total return of the S&P 500 from dividends. Importantly, this study is on the entirety of the S&P 500, not just those companies that pay dividends. If the universe only included dividend payers, this analysis would reveal strikingly greater contributions since roughly 100 S&P 500 companies are not currently paying a dividend.

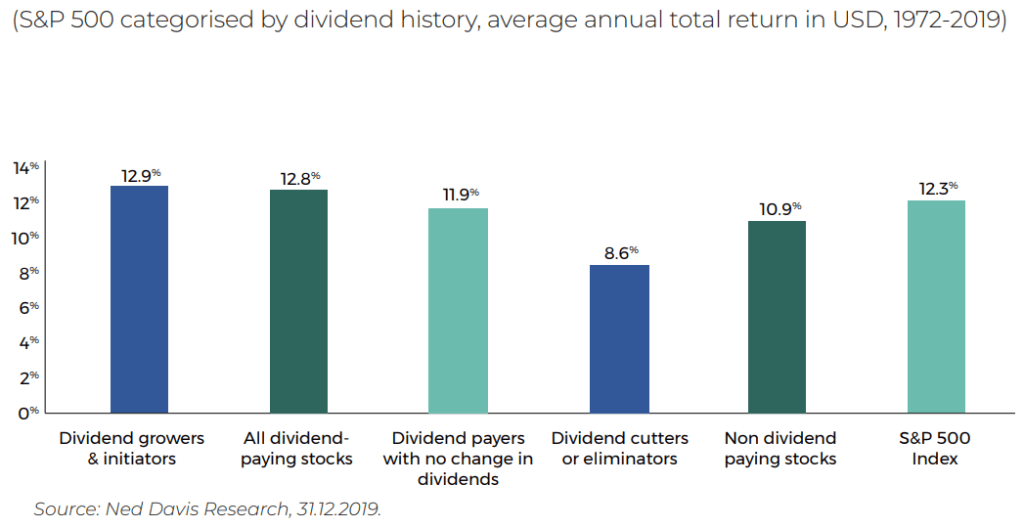

As if this study isn’t enough to convince you of the importance of dividends to the long-term return of stocks, Glen Eagle Trading put out an email today that referenced a recent Wall Street Journal article, titled “Why Investors Are Right to Love Dividends”. The article highlighted the fact that recent studies show S&P 500 dividend-paying stocks returned 9.2% annually over the past 50 years, which is more than double the 4.3% return of non-dividend payers, with lower volatility. Then there is this study by Ned Davis which broke down the contribution of dividends for the 47-years ending December 21, 2019.

Once again, it becomes abundantly clear why investing in companies paying dividends is a terrific long-term strategy. It also begs the question, why do many plan sponsors and their advisors regularly “sweep” income from their equity managers to meet ongoing benefits and expenses? In doing so, instead of structuring the pension plan to have a liquidity bucket to meet those obligations, this activity diminishes the potential long-term contribution to equities from dividends. As longer-term returns are reduced, greater contributions are needed to make up the shortfall compounding the problem.

Please don’t sweep interest and dividend income or capital distributions for that matter, establish an asset allocation that has a dedicated liquidity bucket that uses cash flow matching to secure and fund ongoing benefits and expenses. The remainder of the assets not deployed in the liquidity bucket go into a growth bucket that benefits from the passage of time.