By: Russ Kamp, CEO, Ryan ALM, Inc.

Do you, or would you, consider yourself a “high earner” with a salary of $145k/year?

Try asking a family of four in NYC that question, when you consider the expenses from taxes (federal, state, city, sales, and property), the housing costs associated with an apartment, childcare, healthcare, food, clothing, etc. Yet, those at the IRS certainly do. In case you didn’t realize it, SECURE 2.0 is eliminating the tax deductibility of “make up” contributions for those 50 and up after they have maxed out their $23,500 annual contribution beginning in 2027. As a reminder, for those that 50-years old and up one can contribute another $7,500. For those between the ages of 60-and 63-years-old there is a super catch up contribution of $11,500. Why a 64- or 65-year-old can’t contribute more is beyond me. Perhaps it will blow out the U.S. federal budget deficit!

Unfortunately, if you are so lucky to earn a whopping $145k from a single employer in a calendar year, you will be forced to use a Roth 401(k) for those make up contributions. As stated previously, you lose the tax deductibility for those additional contributions. So, if you earn $200k and you contribute the additional $7,500 or the $11,500, instead of seeing your gross income fall by those figures, you will be taxed at the $200k level, increasing your tax burden for that year. Yes, the earnings within the account grow tax free, but the growth in the account balance is subject to a lot of risk factors.

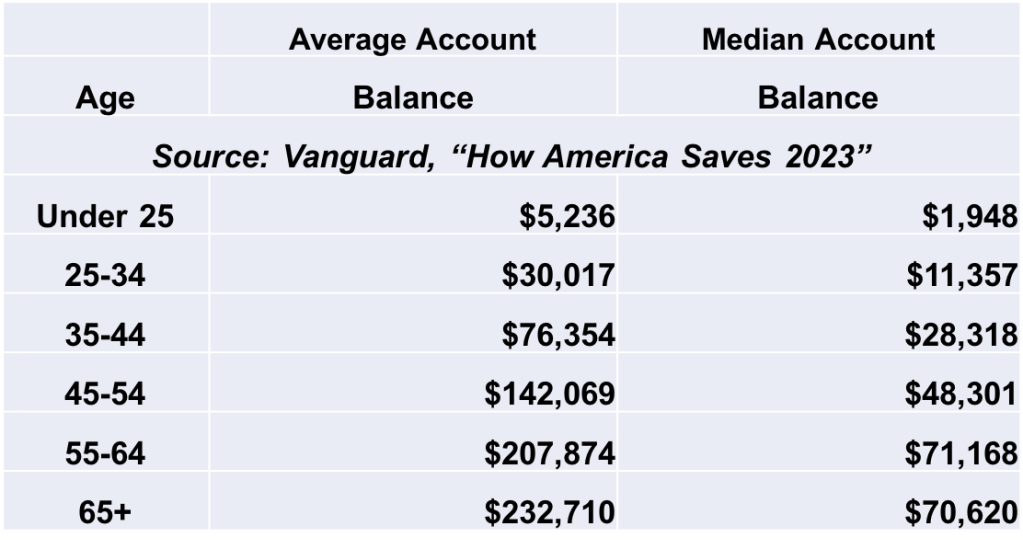

We should be incentivizing all American workers to save as much as possible. Let’s stop with all these different gimmicks. Do we really want a significant percentage of our older population no longer participating in our economy? Those 65-years and older represent about 17% of today’s population, but they are expected to be 23% by 2050. Do we really want them depending on the U.S government for social services? No, and they don’t want that either. We want folks to be able to retire with dignity and remain active members of our economic community.

The demise of the traditional DB pensions has placed a significant burden on most American workers who are now tasked with funding, managing, and then disbursing a “retirement” benefit with little disposable income, no investment acumen, and a crystal ball to determine longevity as foggy as many San Francisco summer days. Again, with the burdens associated with all of the expenses mentioned above and more, it really is a moot point for many Americans to even consider catch up contributions, but for those lucky few, why penalize them?