By: Russ Kamp, CEO, Ryan ALM, Inc.

Welcome to the last week in February. Spring can’t arrive soon enough in New Jersey!

Last week the Milliman organization published its annual review of the state of multiemployer pension plans. The news was quite positive, but in digger deeper, it became apparent that the payment of the Special Financial assistance (SFA) was the primary reason for the improved funding ratios. Given how critically important the SFA is to the ongoing success of many of these plans, let’s look at what transpired during the previous week.

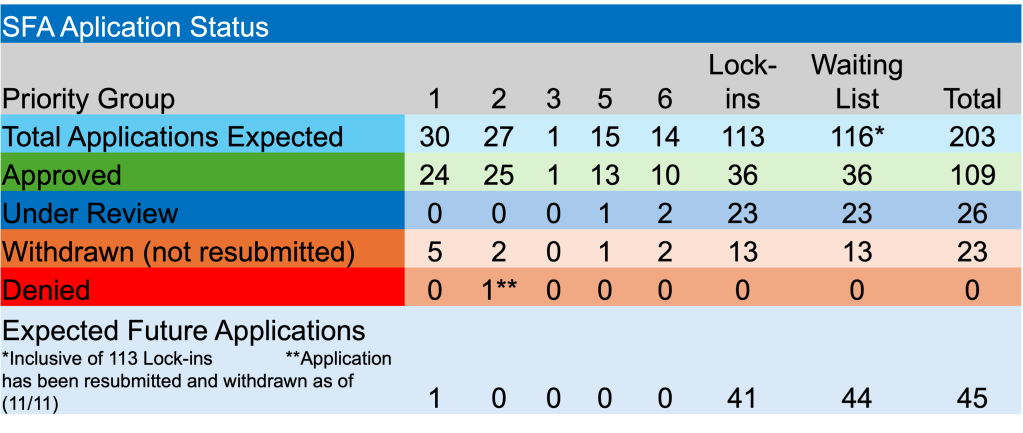

According to the PBGC’s weekly spreadsheet, there were no new applications filed as the eFiling portal remains temporarily closed. In addition, no applications were approved or denied, but there was one application withdrawn, as non-priority plan Aluminum, Brick & Glass Workers International Union, AFL-CIO, CLC, Eastern District Council No. 12 Pension Plan (the plan’s name is longer than the fund’s size is large) pulled its application seeking $10.6 million for 580 participants.

There was some additional activity though, as five plans were asked to repay a portion of the previously agreed SFA due to census errors. In total, these plans repaid $16.3 million representing just 1.06% of the grants received. To date, $180.8 million has been reclaimed from grants totaling $43.6 billion or 0.41%.

In other news, we had Bricklayers & Allied Craftworkers Local No. 3 NY Niagara Falls-Buffalo Chapter Pension Plan, added to the waitlist (#116). This is the first addition to the list since July 2024. This plan did not elect to lock-in the interest rate for discount rate purposes, joining a couple other plans that have kept their options open.

We should witness dramatic improvement in the Milliman funded ratio study next year, as about 7% (85 funds) were funded at <60% in 2024. There are currently 94 plans seeking SFA support. If granted, they should all see meaningful improvement in the funded status of their plans. As a result, we could have a situation in which the multiemployer universe becomes fully funded. How incredible. Now, let’s not do something silly from an investment standpoint that would jeopardize this improved funding.