By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Managing a defined benefit pension plan should be fairly straightforward. The plan sponsor has made a promise to each participant which is based on time of service, salary, and a multiplier as the primary inputs. The plan sponsor hires an actuary to do the nearly impossible of predicting the future benefits, administrative expenses, salaries, mortality, etc., which for the most part, they do a terrific job. Certainly in the short-term. Since we have a reasonable understanding of what that promise looks like, the objective should be to SECURE that promise at a reasonable cost and with prudent risk. Furthermore, sufficient contributions should be made to lessen the dependence on investment returns, which can be quite unstable.

Yet, our industry has adopted an approach to the allocation of assets that has morphed from focusing on this benefit promise to one designed to generate a target return on assets (ROA). In the process, we have placed these critically important pension funds on a rollercoaster of uncertainty. How many times do we have to ride markets up and down before we finally realize that this approach isn’t generating the desired outcomes? Not only that, it is causing pension systems to contribute more and more to close the funding gap.

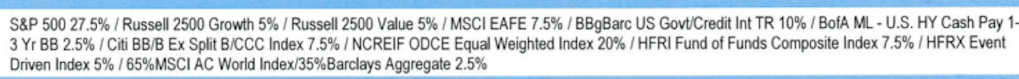

Through this focus on only the asset-side of the equation, we’ve introduced “benchmarks” that make little sense. The focus of every consultant’s quarterly performance report should be a comparison of the total assets to total liabilities. When was the last time you saw that? Never? It just doesn’t happen. Instead, we get total fund performance being compared to something like this:

Really?

Question: If each asset class and investment manager beat their respective benchmark, but lost to liability growth, as we witnessed during most of the 2000s: did you win? Of course not! The only metric that matters is how the plan’s assets performed relative to that same plan’s liabilities. It really doesn’t matter how the S&P 500 performed or the US Govt/Credit index, or worse, a peer group. Why should it matter how pension fund XYZ performed when ABC fund has an entirely different work force, funded status, ability (desire) to contribute, and set of liabilities?

It is not wrong to compare one’s equity managers to an S&P or Russell index, but at some point, assets need to know what they are funding (cash flows) and when, which is why it is imperative that a Custom Liability Index (CLI) be constructed for your pension plan. Given the uniqueness of each pension liability stream, no generic index can ever replicate your liabilities.

Another thing that drives me crazy is the practice of using the same asset allocation whether the plan is 60% funded or 90% funded. It seems that if 7% is the return target, then the 7% will determine the allocation of assets and not the funded status. That is just wrong. A plan that is 90% funded has nearly won the game. It is time to take substantial risk out of the asset allocation. For a plan that is 60% funded, secure your liquidity needs in the short-term allowing for a longer investment horizon for the alpha assets that can now grow unencumbered. As the funded status improves continue to remove more risk from the asset allocation.

DB plans are too critically important to continue to inject unnecessary risk and uncertainty into the process of managing that fund. As I’ve written on a number of occasions, bringing certainty to the process allows for everyone involved to sleep better at night. Isn’t it time for you to feel great when you wake up?