By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Not sure why I used the title that I did, but I recently had pudding (vanilla) over the holiday weekend, so maybe that inspired me, and boy, was it good! That said, we, at Ryan ALM, Inc., are frequently challenged about the benefits of Cash Flow Matching (CFM) versus other LDI strategies, most notably duration matching. There seems to be singular focus on interest rate risk without any consideration for the need to create the necessary liquidity to meet monthly benefit payments. Given that objective, it isn’t surprising that duration matching strategies have been the dominant investment strategy for LDI mandates. But does that really make sense?

Are duration matching strategies that use an average duration or several key rate durations along the Treasury curve truly the best option for hedging interest rate risk? There are also consulting firms that espouse the use of several different fixed income managers with different duration objectives such as short-term, intermediate, and long-term duration mandates. Again, does this approach make sense? Will these strategies truly hedge a pension plan’s interest rate sensitivity? Remember, duration is a measure of the sensitivity of a bond’s price to changes in interest rates. Thus, the duration of a bond is constantly changing.

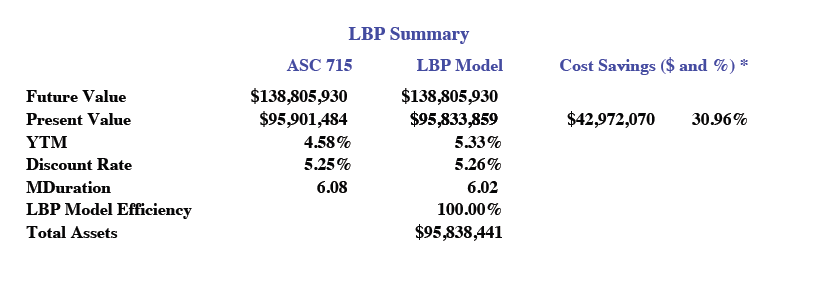

We, at Ryan ALM, Inc., believe that CFM provides the more precise interest rate hedge and duration matching, while also generating the liquidity necessary to meet ongoing benefits (and expenses (B&E)) when needed. How? In a CFM assignment, every month of the mandate is duration matched (term structure matched). If we are asked to manage the next 10-years of liabilities, we will match 120 durations, and not just an “average” or a few key rates. In the example below, we’ve been asked to fund and match the next 23+ years. In this case, we are funding 280 months of B&E chronologically from 8/1/24 to 12/31/47. As you can see, the modified duration of our portfolio is 6.02 years vs. 6.08 years for liabilities (priced at ASC 715 discount rates). This nearly precise match will remain intact as US interest rates move either up or down throughout the assignment.

Furthermore, CFM is providing monthly cash flows, so the pension plan’s liquidity profile is dramatically improved as it eliminates the need to do a cash sweep of interest, dividends, and capital distributions or worse, the liquidation of assets from a manager, the timing of which might not be beneficial. Please also note that the cost savings (difference between FV and PV) of nearly 31% is realized on the day that the portfolio is constructed. Lastly, the securing of benefits for an extended time dramatically improves the odds of success as the alpha/growth assets now have the benefit of an extended investing horizon. Give a manager 10+ years and they are likely to see a substantial jump in the probability of meeting their objectives.

In this US interest rate environment, where CFM portfolios are producing 5+% YTMs with little risk given that they are matched against the pension plan’s liabilities, why would you continue to use an aggressive asset allocation framework with all of the associated volatility, uncertainty, and lack of liquidity? The primary objective in managing a pension plan is to SECURE the promised benefits at a reasonable cost and with prudent risk. It is not an arms race designed on producing the highest return, which places most pension plans on the asset allocation rollercoaster of returns.