By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Good morning, and welcome to a new month/quarter. Still feels like winter in the northeast! But there has been a thaw with regard to activity at the PBGC as they implement the ARPA legislation.

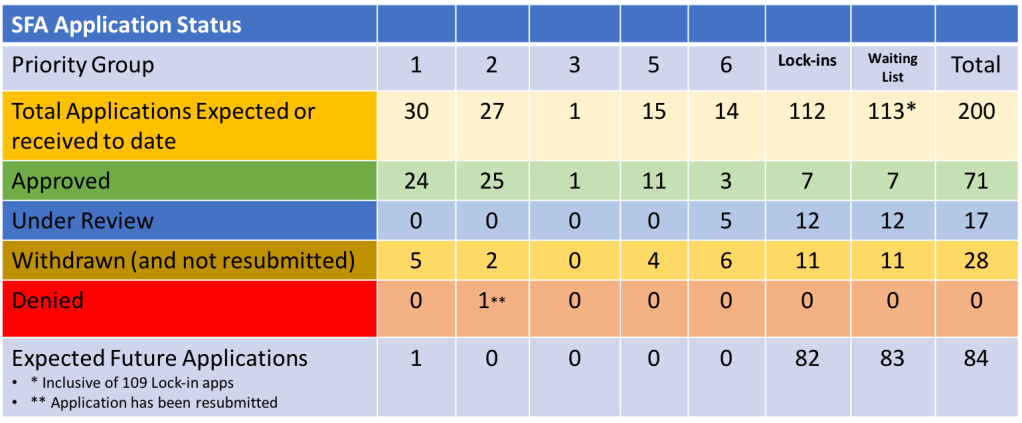

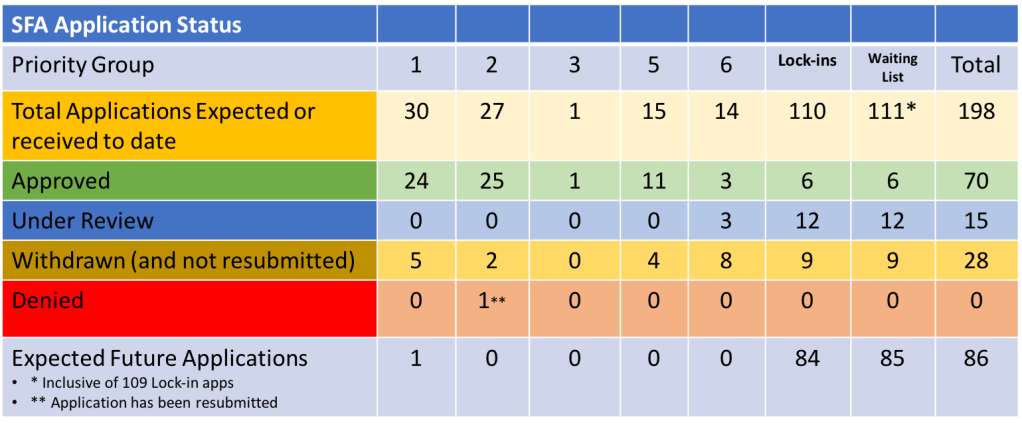

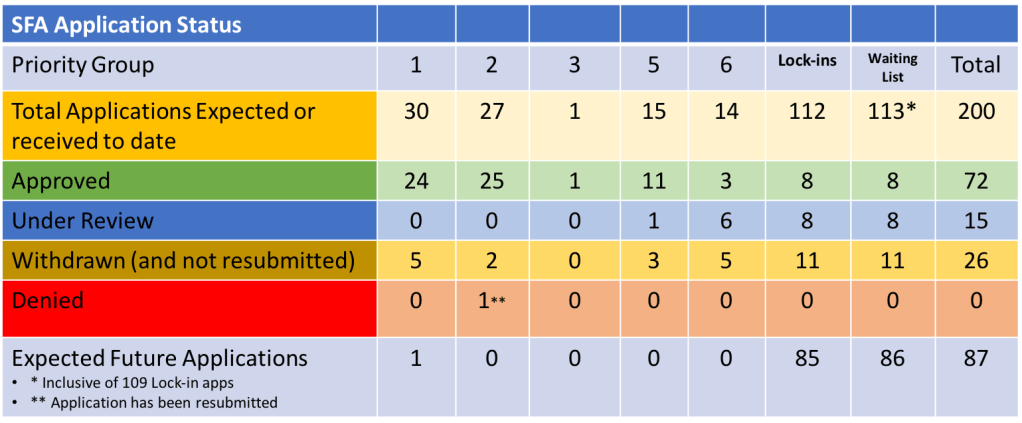

Happy to report that the Pension Plan of the Moving Picture Machine Operators Union Local 306 and the New England Teamsters Pension Plan both submitted applications seeking SFA. The Machine Operators, a priority group 5 member, is seeking $19.4 million for its 542 participants, while the NE Teamsters are hoping to capture more than $5.4 billion in SFA for just over 72k plan members. If the NE Teamsters are successful, they will have received the second largest grant to date only trailing the Central States Teamsters whopping $35.8 billion. To date, there have been 5 awards of greater than $1 billion. Currently, there are four plans seeking >$1 billion that are under review including the NE Teamsters.

In other news, the United Food and Commercial Workers Union Local 152 Retail Meat Pension Plan, had its application approved for an SFA grant of $279.3 million which will support the benefits for 10,252 members. There were no applications denied or withdrawn during the previous week. In addition, there were no pension funds added to the waitlist that continues to have 86 potential applications waiting to submit an application from the initial 113 members.

The upcoming week will provide some insight into the continuing strength of the US labor market with the ADP and US employment releases as well as the weekly initial claims data. However, it doesn’t appear that market participants are waiting to see what those data sets reveal as US Treasury bonds and notes are seeing a big move up in yields today. This movement hurts total return focused fixed income products, but it provides those pension plans with more attractive yields for cash flow matching assignments. Higher yields mean lower cost to defease future benefit payments. Very nice!