By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Welcome to Autumn! It has always been my favorite season since I was a young boy. I would often listen to NY Giants football on the radio as I spent Sunday afternoons outside in the crisp fall air while raking leaves or lying in a freshly created pile. Unfortunately, the Giants weren’t very good in the ’60s and ’70s. I guess what goes around comes around.

I knew that this day would come since I publish an update on the weekly activity associated with the ARPA pension legislation. There was no obvious activity by the PBGC last week. In their latest update, the PBGC is not reporting any new applications received (the efiling portal remains temporarily closed), no applications were approved, denied, or withdrawn, no plans repaid a portion of the SFA due to census errors, and finally, no multiemployer plans sought inclusion on the waiting list. Oh, well. Even the PBGC needs a rest once in a while.

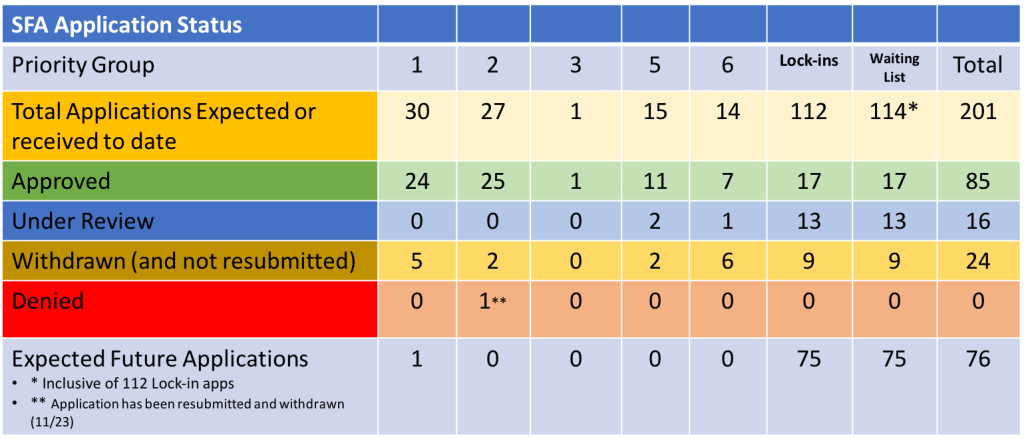

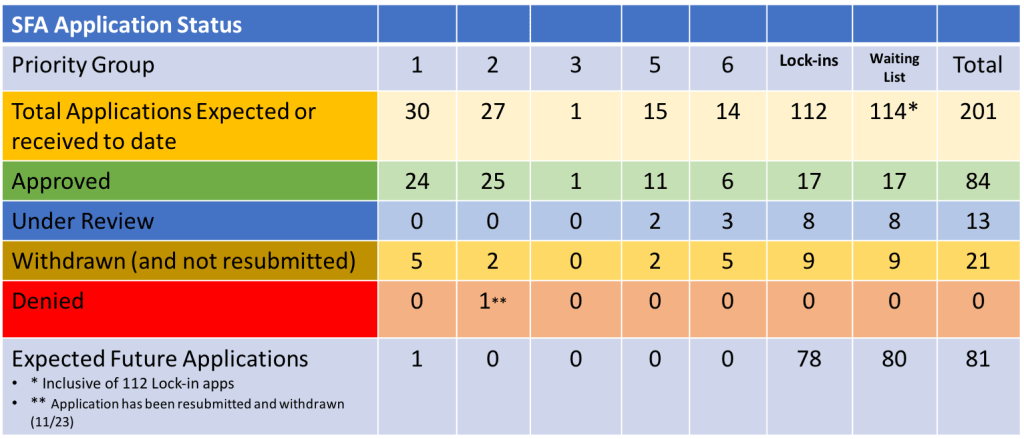

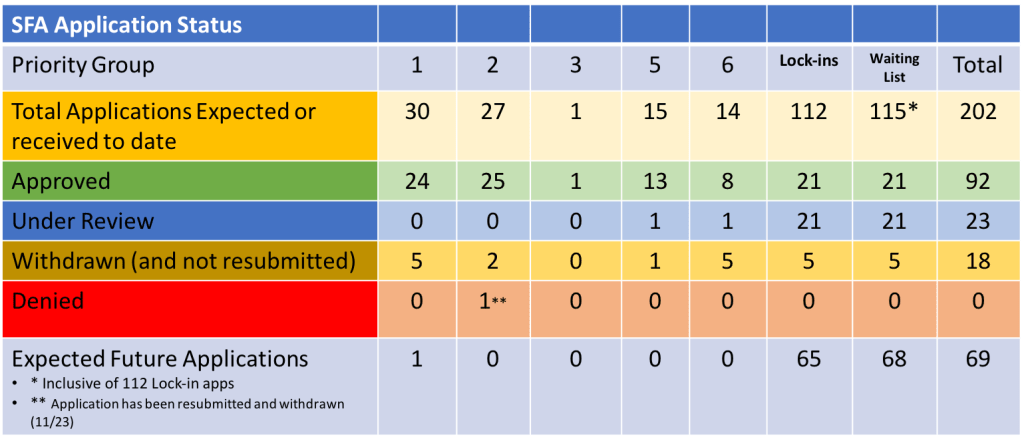

Perhaps the PBGC was focused on the Fed’s interest rate policy decision like the rest of us. So, I’ll take advantage of the clean slate and use my weekly update to summarize where we are at this stage of the PBGC’s implementation of the ARPA pension legislation which began in July 2021. To date, 92 multiemployer plans have received Special Financial Assistance totaling $68.0 billion in grants (inclusive of supplemental awards, interest, and FA Loan Repayments). Of the 92 approved applications, 38 (41.3%) were the initial application attempt. There has been only one plan that had its application denied for ineligibility. Bakery Drivers Local 550 and Industry Pension Fund had its initial application denied in January 2023. A subsequent application was withdrawn in July 2023.

There are currently 23 applications before the PBGC. Five of those 23 will have the 120-day review period elapse in October. There is still one Priority Group 1 member that hasn’t filed an application out of the 30 funds identified as Priority Group 1 eligible. In addition, there are currently 18 applications that were withdrawn that have yet to refile. As I’ve previously reported, 14 funds have repaid a portion of the SFA received because of overpayment due to incorrect census data. There may be more to come.

The Waitlist had 115 multiemployer plans at one time. Twenty-one of those plans have received SFA grants, another 21 are presently under review, while five applications were withdrawn and not refiled. That leaves 69 plans that have yet to get PBGC approval to submit the initial application. While last week may have been “quiet” for the PBGC from an external point of view, a tremendous effort has been put forth to get to this point with potentially lots more to go.