By: Russ Kamp, CEO, Ryan ALM, Inc.

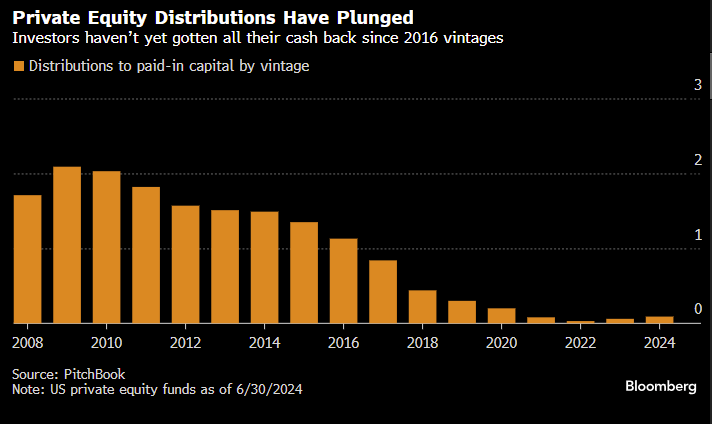

I recently published a blog titled, Problem – Solution: Liquidity, in which I discussed the impact of pension plan sponsors cobbling together interest, dividends, and capital distributions from their roster of managers, and how that practice was not beneficial, especially during periods of stress in the markets. Well, one of those three legs of the “gotta, but how am I gonna, meet my monthly payment of benefits and expenses”, is really falling short at this time.

Dividends are far lower these days than they once were when equities were perceived to be quite risky. In fact, it wasn’t until 1958 that dividend income fell below interest income from bonds. Couple that phenomenon with the fact that capital distributions have plummeted, and plan sponsors are placing far greater emphasis on capturing interest from bonds than ever before. Yes, thankfully interest rates have risen, but the YTM on the BB Aggregate index is still only in the 4.7% range. That is not likely sufficient to meet monthly payouts, which means that bonds will have to be sold, too. The last thing one should want to do in a rising rate environment is to sell securities at a loss.

However, if the plan sponsor engaged a Cash Flow Matching (CFM) manager in lieu of an active core fixed income manager, the necessary liquidity would be made available each and every month of the assignment, as asset cash flows would be carefully matched against liability cash flows. Both interest and maturing principal would be used to meet those benefits and expenses. No forced selling. No scurrying around to “find” liquidity. A far more secure and certain process.

What if my plan isn’t fully funded. Does it make sense to use CFM? Of course, given that benefits and expenses are paid each month whether your plan is fully invested or not, wouldn’t it make more sense to have those flows covered with certainty? Sure, a poorly funded plan may only be able to use CFM for the next 3-5-years, but that’s the beauty of CFM. It is a dynamic process providing a unique solution for each pension plan. No off the shelf products.