By: Ronald J. Ryan, CFA, Chairman, Ryan ALM, Inc.

Bonds are the only asset class with the certainty of its cash flows. That is why bonds have always been used to cash flow match and defease liabilities. Given this certainty, bonds provide a secure way to reduce the cost to fund liabilities. This benefit is not as transparent or valued as one might think. If you could save 20% to 50% on almost anything, most people would jump at the opportunity? But when it comes to pre-funding pension liabilities there seems to be a hesitation to capture this prudent benefit.

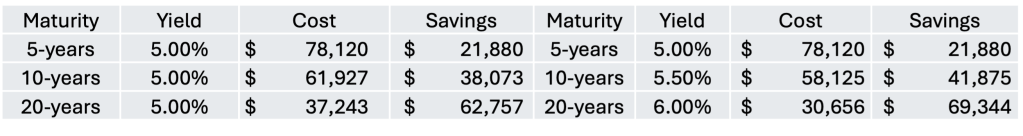

Bond math tells us that the higher the yield and the longer the maturity… the lower the cost. Usually there is a positive sloping yield curve such that when you extend maturity you pick up yield. What may not be evident is the fact that extending maturity is the best way to reduce costs even if yields were not increased. Here are examples of what it would cost to fund a $100,000 liability payment with a bond(s) whose maturity matches the liability payment date:

Cost savings is measured as the difference between Cost and the liability payment of $100k. As you can see, extending maturity produces a much greater cost reduction than an increase in yield. More importantly, the cost reduction is significant no matter what maturity you invest at, even if yields are unchanged. The cost savings range from 21.9% (5-years) to 38.1% (10-years) and 62.8% (20-years) with rates unchanged. Why wouldn’t a pension want to reduce funding costs by 21.9% to 62.8% with certainty instead of using bonds for a volatile and uncertain total return objective? Given the large asset bases in many pensions, such a funding cost reduction should be a primary budget consideration.

Ryan ALM is a leader in Cash Flow Matching (CFM) through our proprietary Liability Beta Portfolio™ (LBP) model. We believe that the intrinsic value in bonds is the certainty of their cash flows. We urge pensions to transfer their fixed income allocation from a total return objective versus a generic market index (whose cash flows look nothing like the clients’ liability cash flows) to a CFM strategy. The benefits are numerous:

Secures benefits for time horizon LBP is funding (1-10 years)

Buys time for alpha assets to grow unencumbered

Reduces Funding costs (roughly 2% per year)

Reduces Volatility of Funded Ratio/Status

Reduces Volatility of Contribution costs

Outyields active bond management

Mitigates Interest Rate Risk

Low fee = 15 bps

For more info on our Cash Flow Matching model (LBP) or a free analysis to highlight what CFM can do for your plan, please contact Russ Kamp, CEO at rkamp@ryanalm.com