By: Russ Kamp, CEO, Ryan ALM, Inc.

I hope that you and/or the men in your life had a wonderful Father’s Day.

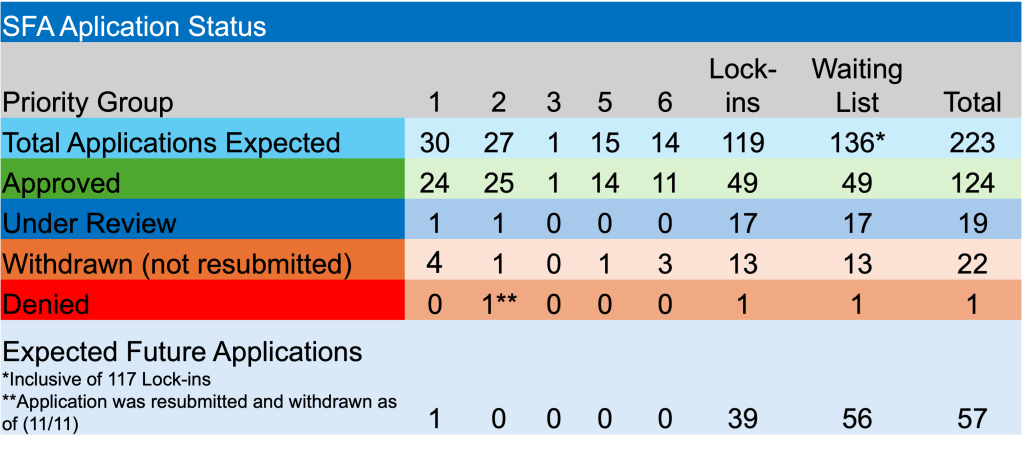

Regarding the ARPA legislation and the PBGC’s oversight, last week was fairly tame in terms of activity. There weren’t exciting developments such as approvals or submissions of applications, as access to the PBGC’s eFiling portal remains “limited”, which means that it “is open only to plans at the top of the waiting list that have been notified by PBGC that they may submit their applications. Applications from any other plans will not be accepted at this time.”

There were no applications denied, withdrawn, and no further recipients of the SFA required to repay a portion of the grant due to census errors. It has been a little over a month (5/5/25) since the last plan repaid a portion of the SFA. As I’ve mentioned several times, there likely aren’t many plans that still might be asked to return a portion of the grant monies.

So what did transpire during the previous week? Well, mutliemployer plans continue to be added to the waitlist. In fact, since April 30, 2025, twenty pension plans have been added to the list. In total, 136 pension plans have sought Special Financial Assistance through the waitlist path with 56 of those yet to file an application with the PBGC. Two of the recent waiting list additions to the waitlist have locked in the valuation date as of March 31, 2025. As a reminder, a “lock-in application will set the plan’s SFA measurement date and base data but has no impact on the process PBGC follows for accepting complete SFA applications for review”, per the PBGC.

Continuing uncertainty surrounding economic policies and geopolitical risks has U.S. Treasury yields hovering around cycle highs. This rising rate environment is not helpful to active core fixed income managers, but it is quite helpful to plan sponsors looking to secure the promised benefits through the SFA grants.