By: Russ Kamp, CEO, Ryan ALM, Inc.

Welcome to February! I am a day late in reporting on the PBGC’s activity from last week, as I was an instructor at the IFEBP’s Advanced Trustee and Administrator’s Conference. Fortunately, it is in Orlando and not New Jersey, where the weather remains cold, snowy, and wet! For one of the first times in my 43-year professional career I’m hoping for a significant flight delay of perhaps three days!

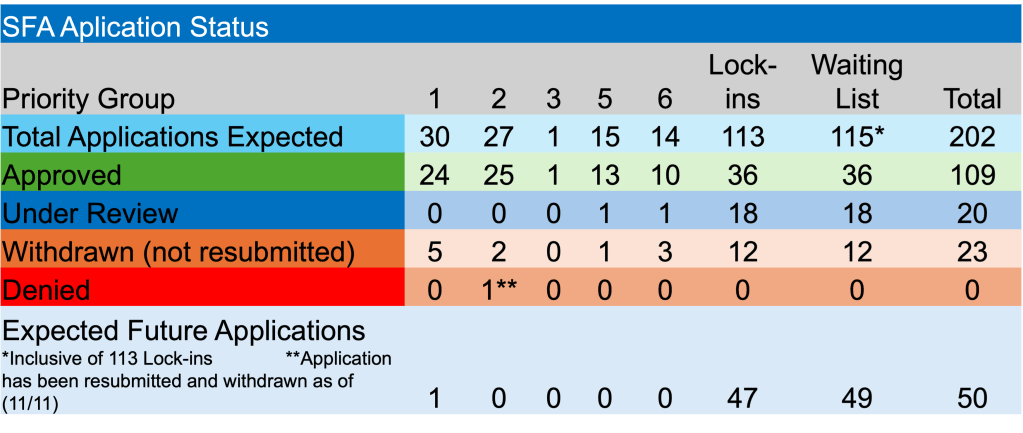

The PBGC’s eFiling portal is now open but defined as limited. During the previous week there was one new application submitted. The Retail Food Employers and United Food and Commercial Workers Local 711 Pension Plan is seeking $64.2 million in Special Financial Assistance (SFA) for their 25,306 plan participants or $2,538.65 per member, which seemed modest, and in fact it is, as the average SFA payout has been $46,385 per beneficiary on applications that have been approved.

In addition to the one new application, two non-priority plans, Laborers’ Local No. 130 Pension Fund and Pension Plan of the Asbestos Workers Philadelphia Pension Fund each withdrew an initial application. Collectively, they are seeking $72.4 million for 2,124 members.

There were no applications denied or approved during the past week. In addition, there were no plans required to repay an overpayment of SFA due to census errors. There hasn’t been a repayment since December 2024. Finally, there were no plans seeking to be added to the waitlist. There are still 49 plans waiting to submit an initial application to the PBGC.

The U.S. interest rate environment remains favorable for plans looking to defease the pension liabilities with the proceeds from the SFA. Investment-grade corporate bond portfolios are currently producing yields above 5% despite very tight spreads between corporates and the comparable maturity Treasury. Given the elevated valuations for domestic equities, particularly large cap stocks, now is the time to use 100% of the SFA to secure the promises.

Hello Russ hope you enjoyed your stay in Orlando you were not far from me and had I known would of been my pleasure to buy you a coffee.

Today’s question is if a plan was deemed eligible under ARPA and so listed in the congressional report of being 30.1% funded with a $936 million underfunding status and also met the condition of :

being in critical status in any plan year from 2020 through 2022, has a modified funded percentage of less than 40% (calculated as the current value of plan assets divided by the present value of plan liabilities, using a specified interest rate), and the ratio of active to inactive participants is less than 2:3;

And subsequently through a union negotiated arrangement with fund employers the plan received a $400 million lump sum payment bring the plan in plan year 2023 to a 106% funding status using the funds projected 7% return is this plan still eligible to apply for and receive SFA funding ?

My conclusion is yes because in all fund years 2020-2022 the fund was listed in critical status meeting that requirement making its current status irrelevant and using the ARPA funding criteria the fund would at present be approximately 60% funded and eligible for an approximately $500 million in SFA assistance.

Please share your thoughts.

Thank you

John R.

Hi John – Thanks for the question and the offer to buy me a coffee. I’d be more than happy to join you the next time I’m there. I believe that you are correct in your understanding of the legislation and your fund’s particular situation. however, I would like to check with someone who I trust to ensure that you and I are both interpreting this correctly. Have a great day.

Russ

Thanks Russ I eagerly await your reply.

Hi John – I hope that my note finds you well.

I have reached into my community to get some additional insights into your question. Those that I’ve spoken with believe, as you do, that if eligible back in the 2020-22 period, your fund remains eligible despite the $400 million contribution. If, as you said, they were originally in line for $900 million in SFA, why would they have arranged for $400 million in private funds? Good luck and hopefully your fund will apply for the residual amount. All the best, Russ

I have reached out to very knowledgeable folks. I hope to hear bak soon. Russ

Hello Russ anything at all back from your sources regarding this ?