By: Russ Kamp, CEO, Ryan ALM, Inc.

Credit to the PBGC for not letting Valentine’s Day get in the way of a productive week, as they continue to implement the ARPA legislation, which is quickly approaching its fourth anniversary!

The eFiling portal has been sporadically open since the beginning of the year. Last week they turned the spigot on a little more, as three non-priority group plans submitted applications, including Teamsters Local 277 Pension Fund, Teamsters Local 210 Affiliated Pension Plan and Cement Masons Local No. 524 Pension Plan. In the case of Local 277, this was the initial filing, while the other two submitted revised applications. In total, these three pension plans are seeking $153.2 million in SFA for the nearly 10k participants.

In other news, the checks are no longer in the mail, as Laborers’ Local No. 265 Pension Plan, Local 734 Pension Plan, Upstate New York Engineers Pension Fund, and The Legacy Plan of the UNITE HERE Retirement Fund received the approved SFA plus interest and FA loan repayments. The $800 million gorilla within this group was Unite Here receiving $868.8 million from a total distribution of $1.1 billion. I suspect that the 103,118 members of these plans slept pretty well this weekend knowing that the promised benefits had been secured.

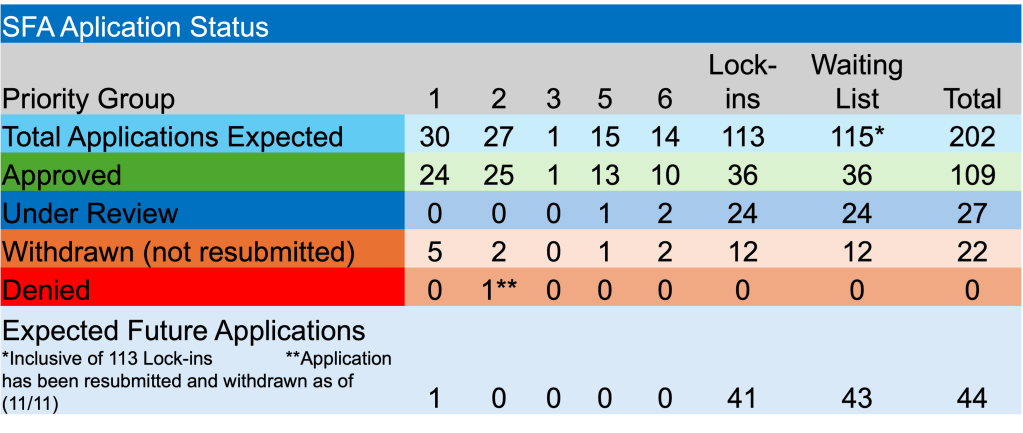

I’m pleased to report that no applications were denied during the past week. In addition, there were no plans required to repay excess SFA on account of census issues. Lastly, there were no new funds seeking inclusion on the waitlist. The chart below highlights where we are in the process. Despite the significant progress to date, there remains quite a bit of work for the PBGC.

Don’t forget, the legislation requires pension funds receiving SFA to rebalance the allocation between fixed income and equities back to 67%/33% one day every 12-months. Given the significant outperformance of equities vis-a-vis bonds plus the monthly benefit payments most likely coming from the fixed income program, there should be some significant rebalancing needs. It seems like a good time to reduce risk and take some profits.