By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Happy Holidays from all of us at Ryan ALM, Inc. We wish you and yours a joyous holiday season and a spectacular 2025 filled with great health, abundant friendships, and calm markets.

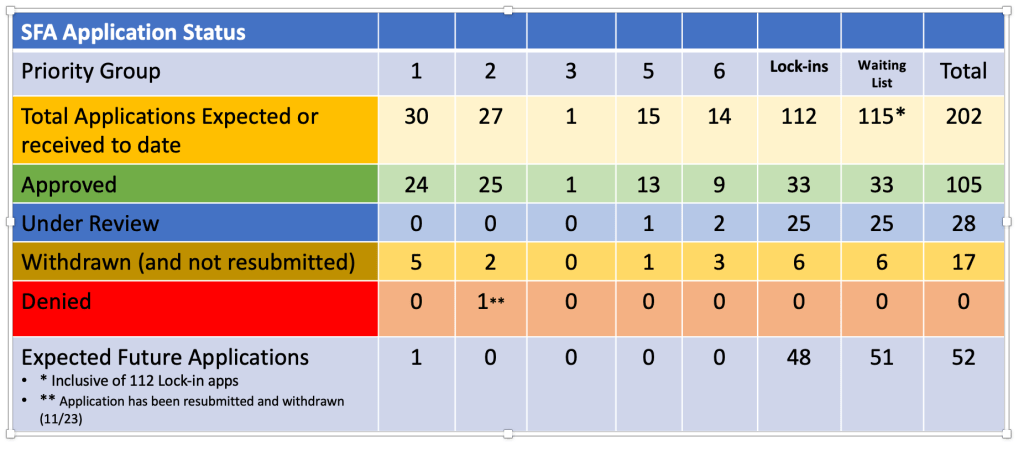

Despite the onset of the holiday season, the PBGC was still at work implementing the ARPA legislation. Santa arrived early for one plan, as Roofers Local No. 75 Pension Fund received approval for its SFA grant. They will receive $6.8 million for the 275 plan participants. This was the initial filing for this non-priority group member. Congrats!

In other ARPA-related news, there were no new applications submitted as the PBGC’s efiling portal remains temporarily closed. There are currently 28 applications under review, including one Priority Group 5 member and two Priority Group 6 members. Fortunately, there were no applications denied or withdrawn during the previous week.

Lastly, there was one fund that repaid excess SFA assets due to census errors. Gastronomical Workers Union Local 610 and Metropolitan Hotel Association Pension Fund repaid $696k (or 2.09%) after receiving $33.3 million in SFA. This fund is one of only 3 to repay SFA in excess of 2% of the grant received. In total, $159.3 million has been repaid on grants of more than $41 billion or 0.38% of the allocations.

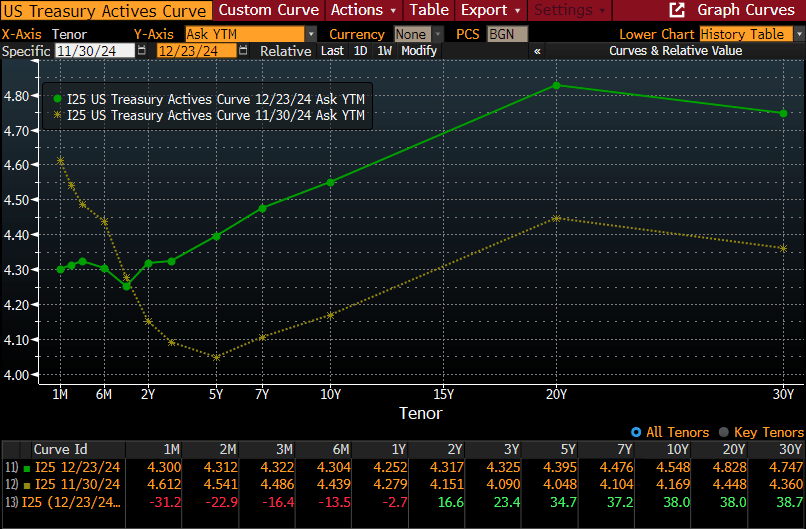

The Bloomberg chart below demonstrates the significant rise in U.S. rates during the last month. Recipients of SFA funds would be wise to secure the promised benefits with 100% of the grant money. Equity markets appear to be quite frothy. Time to reduce risk, while taking full advantage of the higher interest rates.