By: Russ Kamp, CEO, Ryan ALM, Inc.

Is there such a thing as a retirement anymore? According to Fidelity’s Q4 2024 Retirement Analysis, 41% of “retirees” are working, have worked, or are currently seeking work. I would guess that the need to work is strongly correlated to the demise of the DB pension plan.

In other Fidelity news, a big deal was made out of the fact that 527k participants had account balances >$1 million (2.2% of their account holders), but despite those attractive balances, the “average” balance was still only 131k at year-end following two incredible years of growth for the S&P 500 specifically, and equities generally, especially if you rode the tech sector.

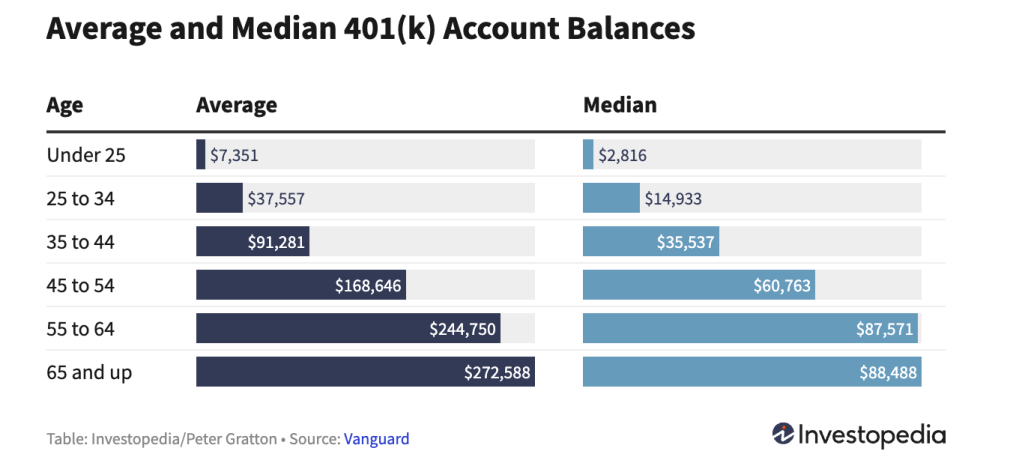

Regrettably, there was once again NO mention of the median account balance, which we know is rather anemic. Can the providers of 401(k)s, IRAs, and 403(b)s, please stop highlighting average accounts which are clearly skewed by the much larger balances of a few participants? According to an analysis provided earlier this year by Investopedia, median account balances at Vanguard were dramatically lower than average accounts. As the chart below highlights, there was not a median balance within 40% of the average balance. In fact, those 65-years-old and up had an account balance at 32% of the average balance. I can’t imagine that this ratio would be much different at Fidelity or any other provider of defined contribution accounts.

It is truly unfortunate that a significant percentage of the American workforce will never enjoy the rewards of a dignified retirement. My Dad, who just recently passed at age 95, enjoyed a 34-year retirement as a result of receiving a modest DB pension benefit. That monthly payment coupled with my parents Social Security enabled them to enjoy their golden years. Providing this opportunity for everyone needs to be the goal of our retirement industry.

Note: Fidelity’s 401(k) analysis covers 26,700 corporate DC plans and 24.5 million participants.