By: Russ Kamp, CEO, Ryan ALM, Inc.

Happy belated Mother’s Day to all the Moms. We hope that you had a special day.

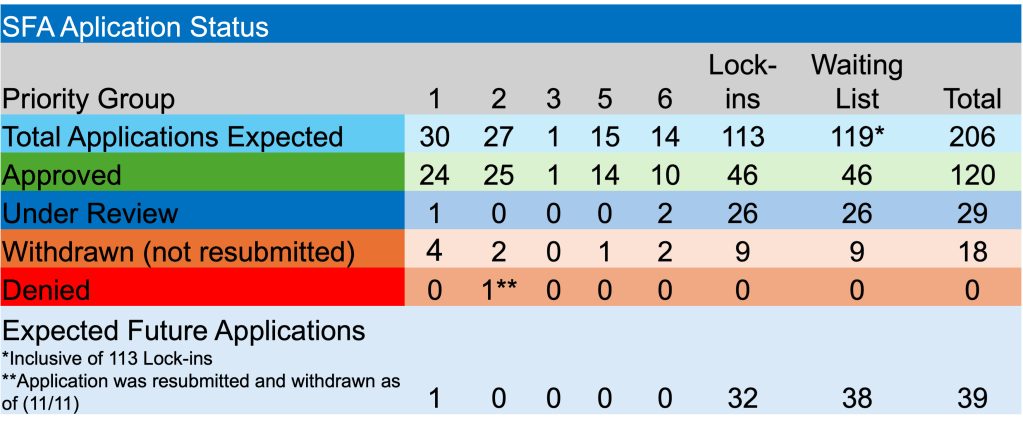

Pleased to report that the PBGC had a very productive week ending last Friday. There were several actions taken including the filing of three initial applications from the waitlist. Alaska United Food and Commercial Workers Pension Fund, Local 73 Retirement Plan, and Local 807 Labor-Management Pension Fund are hoping to secure nearly $300 million for just over 10k plan participants. With these filings, the PBGC currently has 29 applications under review. As a result, their eFiling portal is temporarily closed. As per the legislation, they must act on an application within 120 days. The United Food and Commercial Workers Unions and Employers Pension Plan application reaches that milestone on May 17th. As a reminder, they are seeking $54 million in SFA for there more than 15k members. The PBGC will have its hands full during the next month, as 10 pension plans have applications hitting their 120-day window during June.

In other ARPA news, there were no applications approved, denied, or withdrawn during the past week. However, there was one more fund that repaid a portion of the SFA grant received due to census errors. Local Union No. 863 I.B. of T. Pension Plan repaid $3.2 million in SFA or about 1% of the grant received. To date, 55 plans have reported on potential census errors prior to the PBGC having access to the Social Security Master Death File. Of those 55, 51 have repaid a portion of the proceeds received totaling $214.8 million or 0.44% of the $48.4 billion in SFA received by those funds.

Lastly, there was one more plan added to the waitlist. Greenville Plumbers and Pipefitters Pension Fund becomes the 119th pension fund to seek SFA without being a priority group member. As reflected below, there are 38 pension funds from the waitlist that have yet to file an application with the PBGC.

Recent activity within the U.S. Treasury market have pushed long-term rates up. As of this morning, the 30-year Treasury Bond yield is at 4.89%, while the 10-year Treasury Note’s yield is at 4.48%. Both are quite attractive for a plan looking to secure the promised benefits through the SFA grant.