By: Russ Kamp, CEO, Ryan ALM, Inc.

For those observing, may you have a good Passover and a Happy Easter. I was busy this past weekend stuffing 220 eggs with goodies for our 11 grandkids! Let’s hope that weather cooperates. I’m not overly confident on that happening given that we actually had snow during the weekend in northern NJ.

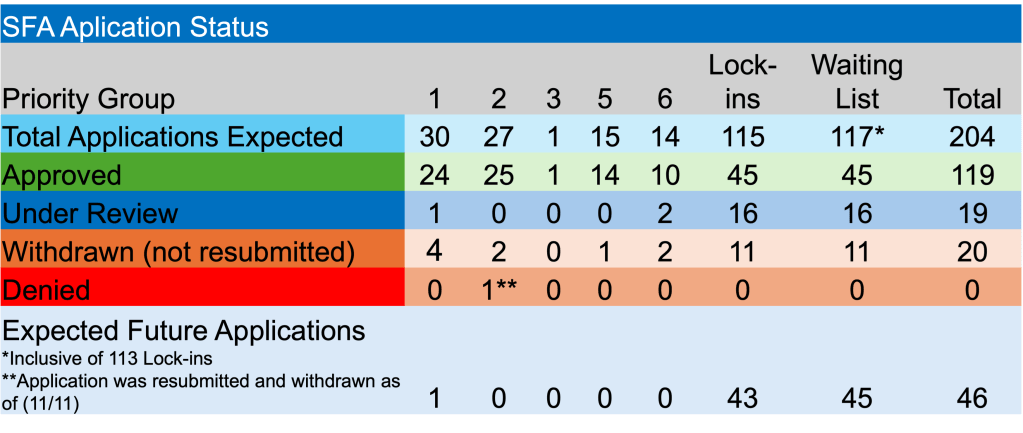

With regard to ARPA and the PBGC’s implementation of this critical legislation, three more plans received approval of their applications during the past week. Bricklayers Pension Fund of West Virginia (revised), United Wire, Metal and Machine Pension Plan (initial), and Local 945 I.B. of T. Pension Plan (revised), all non-priority group members, will receive a combined $289.1 million in Special Financial Assistance (SFA), including interest and FA loan repayments. This brings the total number of pension plans receiving SFA to 119 funds and more than $71.6 billion in grants.

There was no apparent activity beyond the approvals mentioned above, as the PBGC’s eFiling portal remains temporarily closed. The prior week also saw no applications withdrawn or denied, no excess SFA repaid, and no new plans added to the waitlist.

Of the 87 pension plans with a priority designation, 74 have now received approval for an SFA grant (85%) – outstanding! The PBGC still has quite a bit of work to do with 85 plans still in the queue for approval. Fortunately, the challenging capital markets have seen U.S. interest rates rise providing plan sponsors recipients of the SFA to realize greater cost savings and extended coverage through cash flow matching strategies. There is little reason to take on unnecessary risk while uncertainty rules the day.