By: Russ Kamp, Managing Director, Ryan ALM, Inc.

I continue to be involved in programs associated with the Florida Public Pension Trustees Association (FPPTA) for which I remain quite grateful. If you’ve been exposed to their conferences, you know that they do a terrific job of bringing critical education to Florida’s trustee community and have since its founding in 1984. I’m pleased to highlight an expansion of their program to include the Trustee Leadership Council (TLC). This program brings together a small collection of experienced trustees who want to delve more deeply into the workings of defined benefit pensions – both assets and liabilities. Furthermore, the instruction is mostly done through case studies that provide them with the opportunity to roll up their sleeves and really get into the nitty gritty of pension management. Great stuff!

I could go on for days about the FPPTA and their programming, but I want to raise another issue. During a recent conversation with the TLC leadership, information was shared from one particular case study (a non-Florida-based pension plan). This information was for a substantial public pension plan that has had a troubling past from a funding standpoint. We also had info shared from a much smaller Florida-based system. There appeared to be a stark difference in performance of these two systems, as measured by the funded ratios, with a particular focus on 2022’s results. Upon further review, the one actuarial report used a 10-year smoothing for the funded ratio, while the Florida plan highlighted the performance for just 2022 and the impact that had on that plan’s funded ratio. As you can imagine, given the very challenging return environment in 2022, funded ratios took a hit. Question answered!

However, in looking at the actuarial report for the larger system, I saw that 2023’s funded ratio dramatically improved from the depths of 2022’s hit. It seemed outsized given what I knew about the environment that year. Diving a little deeper into the report – is there anything drier than an actuarial report – I found information related to a change in the discount rate that had occurred during 2023. It seems that this system had come up with its own funding method, but that was going to lead to the system becoming insolvent relatively soon. As a result, they passed legislation mandating that future contributions were going to be determined on an actuarial basis. How novel!

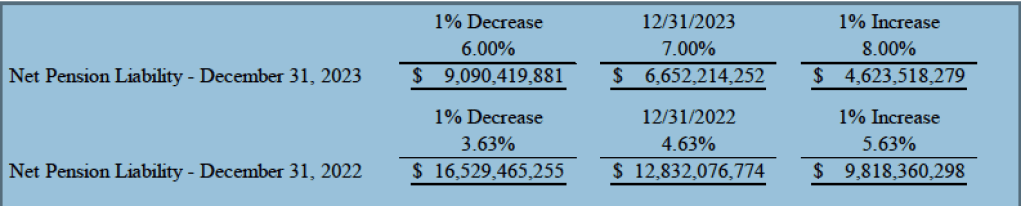

As a result of the move from a 4.63% blended rate (used a combination of the ROA (7%) and a municipal rate) they have now adopted a straight 7% discount rate equivalent to the fund’s return on asset assumption. Here is the result of that action:

As one can see, the present value (PV) of those future promises based on a 4.63% blended rate creates a net pension liability of -$12.8 billion. Using a 7% discount rate creates a PV of those net liabilities of “only ” -$6.7 billion. The dramatic improvement in the funded status from 48.4% to 64.1% is primarily the result of changing the discount rate, as a higher rate reduces the PV of your promise to plan participants. It really doesn’t change the promise, just how you are accounting for it.

The trustees who will participate in the TLC program offered by the FPPTA will receive a wonderful education that will allow them to dive into issues as referenced above. Knowing the ins and outs of pension management and finance will lead to more appropriate decisions related to benefits, contributions, asset allocation, etc.