By: Russ Kamp, Managing Director, Ryan ALM, Inc.

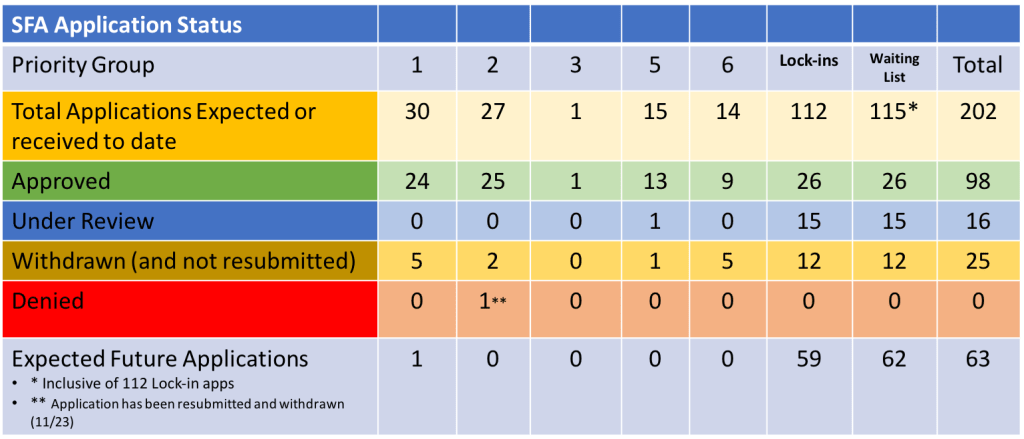

The PBGC continues to implement the ARPA legislation, although last week revealed less apparent activity according to its weekly update. The legislation which was approved in March 2021 and implemented beginning in July of that year, has now been active for about 3 1/3 years. I remain impressed with the PBGC’s effort to-date, as 98 pension plans have received Special Financial Assistance grants and interest totaling more than $69.4 billion. Wow!

Regarding last week’s activity, there was one fund invited to submit an initial application. The Aluminum, Brick & Glass Workers International Union, AFL-CIO, CLC, Eastern District Council No. 12 Pension Plan, is seeking $10.6 million in SFA for 580 plan participants. The PBGC has until March 6, 2025 (I can’t believe that is only 120 days away!) to act on the application.

In other news, Local 734 Pension Plan, an IBT fund out of Chicago, withdrew its initial application seeking $109 million for its 3,453 members. That application had been submitted on July 15, 2024 and it was nearing the PBGC’s 120-day deadline.

There were no applications denied, no excess funds repaid, no applications approved, and no plans added to the waitlist, which continues to list 62 funds yet to file an initial application. Finally, US Treasury interest rates continue to rise across the yield curve providing plan sponsors with the wonderful opportunity to reduce the cost of securing the promised benefits through the SFA grants, while the legacy assets and future contributions benefit from an extended investing horizon.