By: Russ Kamp, Managing Director, Ryan ALM, Inc.

I recently published a post titled, “What Will Their Performance be in About 11 Years?” I compared the Ryan ALM, Inc. cash flow matching (CFM) strategy to a relative return fixed income manager, and I raised the question about future performance. Barring any defaults within the investment grade universe, which historically average about 2/1,000 bonds, we can tell you on day one of the portfolio’s construction what the performance will be for the entire period of a CFM mandate.

In my previous post, I stated, “now, let me ask you, do you think that a core fixed income manager running a relative return portfolio can lay claim to the same facts? Absolutely, not! They may have benefitted in the most recent short run due to falling interest rates, but that future performance would clearly depend on multiple decisions/factors, including the duration of the portfolio, changes in credit spreads, the shape of the yield curve, the allocation among corporates, Treasuries, agencies, and other bonds, etc. Let’s not discount the direction of future interest rate movements and the impact those changes may have on a bond strategy. In reality, the core fixed income manager has no idea how that portfolio will perform between now and March 31, 2035.

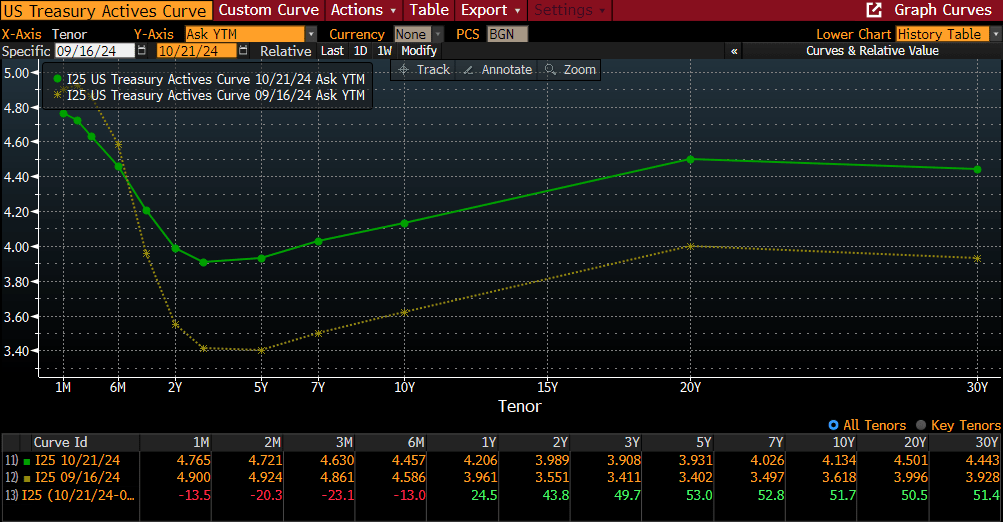

Whatever benefit the active relative-return fixed income manager might have gotten from those declining rates earlier this year has now been erased, as Treasury yields have risen rapidly across all maturities since the Fed announced its first cut in the FFR. Including today’s trading, the US 10-year Treasury note yield has backed up 67 bps since the yield bottomed out at 3.5% in mid-September (currently 4.17% at 11:40 am). The duration of the 10-year note is 8.18 years, as of this morning. That equates to a loss of principal of -5.48% in roughly 1 month. Wow!

Again, wouldn’t you want the certainty of a CFM portfolio instead of the very uncertain performance of the relative return fixed income manager? Especially when one realizes that the active fixed income manager’s portfolio won’t likely cover the liquidity needed to meet benefits and expenses. Having to “sell” bonds in a rising rate environment locks in losses for the active manager, while the CFM portfolio is designed to meet ALL of the liquidity through maturing principal and income – no selling. This seems like a no-brainer!