By: Russ Kamp, Managing Director, Ryan ALM, Inc.

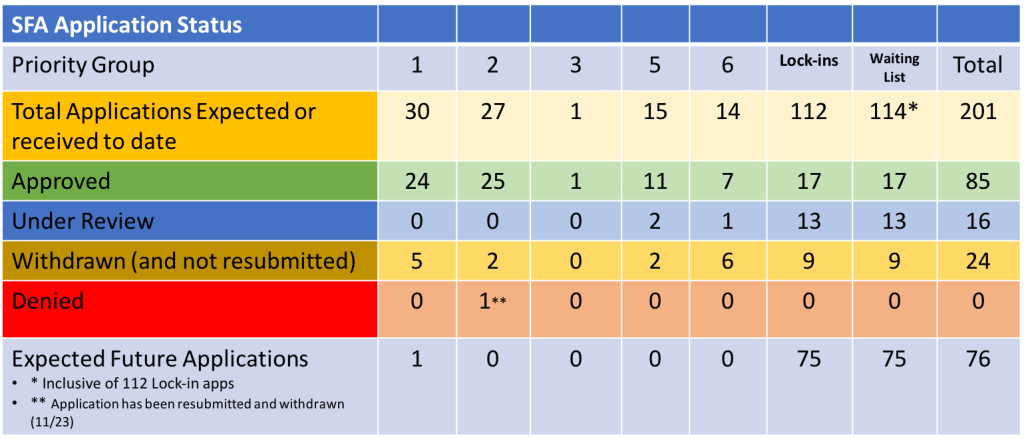

Not only has the weather heated up, but so has the activity at the PBGC as it relates to the implementation of the ARPA pension legislation. During the past week two non-priority group plans submitted applications. In the case of the Carpenters Pension Trust Fund – Detroit & Vicinity, it was a revised application seeking nearly $600 million in Special Financial Assistance (SFA), while the Laborers’ Local No. 265 Pension Plan put forward its initial filing seeking $55.6 million. In total, more than 24,000 plan participants would enjoy a more secure retirement with the approval of these applications.

In other ARPA news, the American Federation of Musicians and Employers’ Pension Plan finally received approval. This fund had multiple filings throughout the process, which began on March 10, 2023 with the initial filing followed by two other applications. The wait was certainly worth it, as they will receive >$1.5 billion to reinforce the pensions of nearly 50,000 eligible participants.

There were no applications denied during the past week, but one fund, the United Food and Commercial Workers Union and Participating Food Industry Employers Tri-State Pension Plan, withdrew its application that had been seeking $638.3 million in SFA for 29+k members. There were no plans that were forced to repay excess SFA assets and no new plans added to the waitlist.

We’ve all heard the phrase with uncertainty comes opportunity, and that may very well be true, but the uncertainty comes with a certain level of risk, too. Given all of the uncertainty in the economic and political spheres at this time, is the opportunity greater than the risk? We would encourage plan sponsors of all plan types to look to reduce some of the risk in their funds, especially given the elevated multiples on which the equity markets are currently trading. The higher US interest rates are providing a unique opportunity not available to us in the past two decades. Secure some of the promises (benefits) by defeasing your liabilities through a cash flow matching strategy. We are happy to discuss this suggestion in far greater detail or you can go to RyanALM.com to read myriad research articles and blog posts on the subject.