By: Russ Kamp, Managing Director, Ryan ALM, Inc.

We hope that you had an enjoyable long holiday weekend. We once again provide you with an update on ARPA and the PBGC’s implementation of this key pension legislation. Following a busy June, in which nine multiemployer plans received Special Financial Assistance (SFA) approval for $6.4 billion for roughly 233k participants, the PBGC’s application portal has been reopened and three applications were filed during the past week. PA Local 47 Bricklayers and Allied Craftsmen Pension Plan, Local 111 Pension Plan, and Bricklayers Pension Fund of West Virginia have each filed its initial application seeking SFA. In total, these three smallish plans are requesting $25.7 million for 2,066 participants.

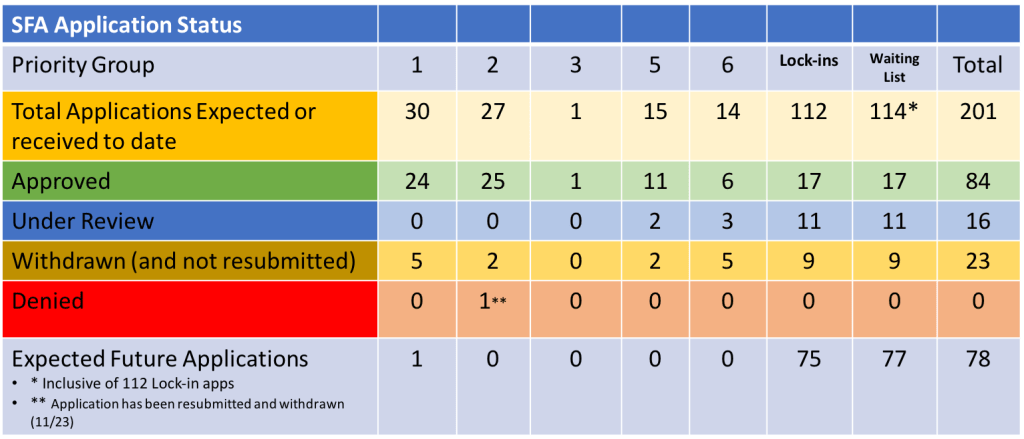

In other developments, there was little obvious activity during the holiday shortened week, as there were no plans receiving approval for SFA, no applications that were denied or withdrawn, and no plans agreed to repay excess SFA grant money. Finally, there were no additional plans added to the waitlist at this time. Currently, 37 non-priority plans, from a list of 114, have seen some action on their application – approved, submitted, or withdrawn.

There remains great uncertainty within the US economy. Is the US labor market weakening? Is inflation truly under control? With the recent fall in Q2’24 GDP growth estimates from 3.1% to 1.5% by the Atlanta Fed (GDPNow model), will the Fed finally have the information that they’ve been seeking to reduce US interest rates? Will these trends begin to weigh on US corporate profits? If so, elevated valuations for US stocks could begin to pressure US stock prices, which seem to have been immune to bad news in the last couple of years. It may be time to rebalance or reduce any exposure to stocks within the SFA bucket and lock in these higher US rates.