By: Russ Kamp, Managing Director, Ryan ALM, Inc.

“March Madness” is upon us. How’s your bracket doing? I still have my champion in the running, but not much more than that.

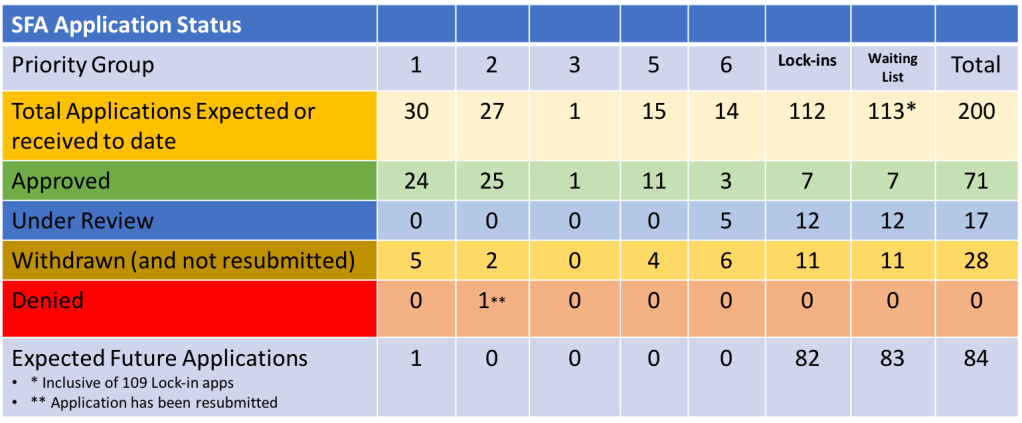

The past week was very quiet with regard to the ARPA legislation and activity associated with its implementation. We did have one fund submit an application for Special Financial Assistance (SFA). United Food and Commercial Workers Union and Participating Food Industry Employers Tri-State Pension Plan, a Priority Group 6 member, submitted a revised application on March 16th. This fund is seeking SFA in the amount of $638.3 million for the fund’s 29,233 members. The PBGC will now have until July 14, 2024 to act on the application.

Besides the filing by the UFCW, there was little to show last week, as there were no applications approved, denied, or withdrawn. Furthermore, unlike the prior week, there were no additions to the waitlist which continues to have 113 funds listed of which 27 have been invited to submit an application. To-date, 71 funds have received SFA in the amount of $53.6 billion. These proceeds include the grant, interest, and any FA loan repayments.

Like the picking of the NCAA tournament bracket, for which there are no perfect submissions remaining, the capital markets are highly uncertain. Yes, the US equity market has enjoyed a robust 5-6 months period, but how predictive is that for the next six months or longer? Those yet to receive the SFA should seriously consider an investment strategy that takes the uncertainty of the markets out of the equation. I am specifically referring to the use of investment grade bonds to defease the promised benefit payments as far into the future that the SFA allocation will cover. Once the matching of asset cash flows to the plan’s liability cash flows is done, that relationship is locked in no matter what transpires in the capital markets. Any risk taken by recipients of these assets should be done in the legacy portfolio where a longer investing horizon has been created. Fortunately, US interest rates remain elevated significantly from when the ARPA program began in 2021. The timing couldn’t have been better.