By: Russ Kamp, CEO, Ryan ALM, Inc.

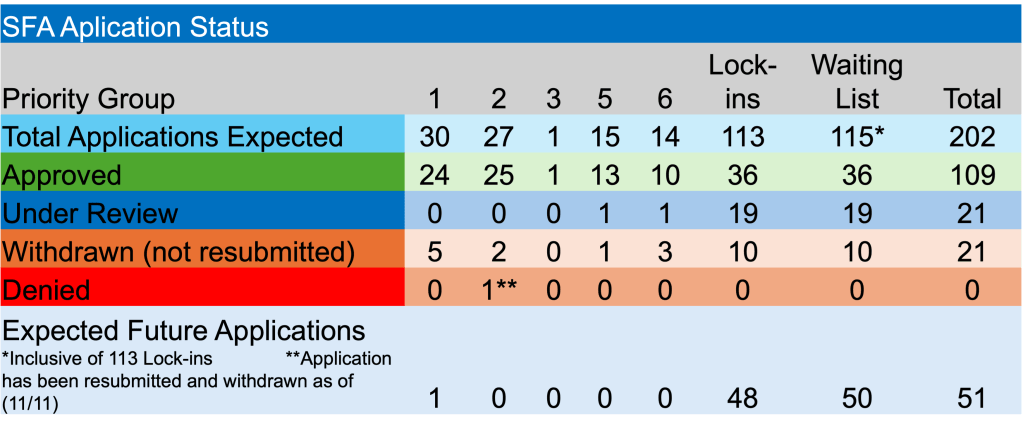

Somewhat shockingly, one month of 2025 is now in the books. That said, the PBGC continues to implement the ARPA legislation, which will soon celebrate its fourth anniversary since being signed into law on March 11, 2021. By all measures, this has been an incredibly successful program, with much yet to be accomplished with 93 pension plans still in the process of securing Special Financial Assistance (SFA).

The last few weeks have witnessed a moderation in the pace of implementation. The prior week saw no new applications received or approved. There was one application withdrawn, as Rocky Hill, CT-based, Sheet Metal Workers’ Local No. 40 Pension Plan withdrew their initial application seeking $18.8 million in SFA for 984 plan participants. In addition, there was one plan, St. Louis Motion Picture Machine Operators Pension Fund, that locked in the measurement date (liability valuation) as of October 31, 2024. They submitted the request as of January 24, 2025. With this action, there are only 2 plans of the 115 non-priority plans to have not locked in a valuation date.

I’ve previously mentioned the onerous impact of MPRA which passed in 2014. Fortunately, the PBGC/ARPA provided SFA of $477 million to restore to the 18 plans affecting 11 unions that under MPRA had reduced benefits an average of 22% for 60,620 retirees in pay status with some plans reducing benefits as much as 55 percent. These plans received an additional $3.5 billion in SFA to help ensure they remain solvent and able to pay all 87,862 participants in those plans their full retirement benefits through at least 2051.