By: Russ Kamp, Managing Director, Ryan ALM, Inc.

We’ve been quite surprised by the magnitude of the moves in both US interest Rates (down) and US equities (up) since mid-June. In fact, July is one of only a handful of observations since WWII in which a -7.5% or worse monthly performance (June) was followed by a +7.5% or greater performance for US equities (as measured by the S&P 500). Those previous monthly gyrations have led to extraordinary returns 12 months out. But be careful not to jump with both feet into the water. False signals can be quite dangerous to one’s financial health, especially in light of the fact that each of those previous occurrences followed aggressive easing by the Fed. That isn’t about to happen anytime soon.

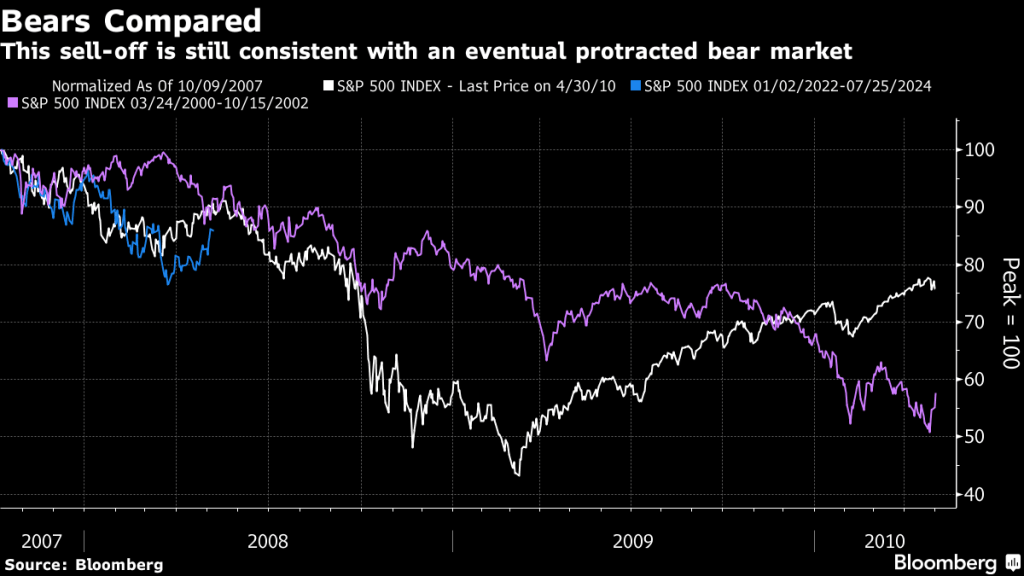

As the chart above highlights, 2022’s equity performance is revealing a pattern not too dissimilar from those of two recent significant market corrections earlier this century. In fact, the patterns are strikingly similar. It certainly seems to us that recent risk-off trades predicated on the belief that the Federal Reserve has actually accomplished its objective of taming inflation seem premature at best, if not just plain silly. The Fed has raised the Fed Funds Rate from effectively 0 to 2.25% at this time. They’ve indicated that another 0.75% increase in September is on the table, while not eliminating the possibility that additional increases might be necessary until they have tackled inflation. Yet, market participants are behaving as if we will see an immediate economic response to these recent increases off a historically low base causing the Fed to swiftly do an about-face. Do investors truly believe that the current interest rate environment is going to choke economic activity? Again, are we ALL collectively anchored with the concept of low rates forever?

In a blog post that we recently produced, the 1970s’ interest rate and inflationary environment took 10 years to unwind. Interest rates began that inflationary cycle in the low 3% range and it wasn’t until 1983 that they once again displayed a 3 before the decimal place. Today we started the day with all Treasury maturities with yields below 3% except for the 1-year T-Bill. That doesn’t seem like a level of rates that would keep most people on the sidelines. For those of us that remember buying our first homes with interest rates in the 11+% range of the early to mid-’80s that thought is almost laughable.

We’ve been encouraging the plan sponsor community to de-risk since last year’s fourth quarter. If you haven’t done so yet, the time is ripe to take profits now as we believe that this correction, due to significant inflationary pressures, is only in the second inning. We look forward to helping you accomplish this objective.

Have real interest rates (nominal rate minus inflation) ever been below -5%, let alone the current -7%? Bond investors should not stand for the big ripoff.

Good morning, Ron. You have to go back to the ’70s when we last had real negative rates of >-5%.