The following information was provided by the Boston College Center For Retirement Research.

The brief’s key findings are:

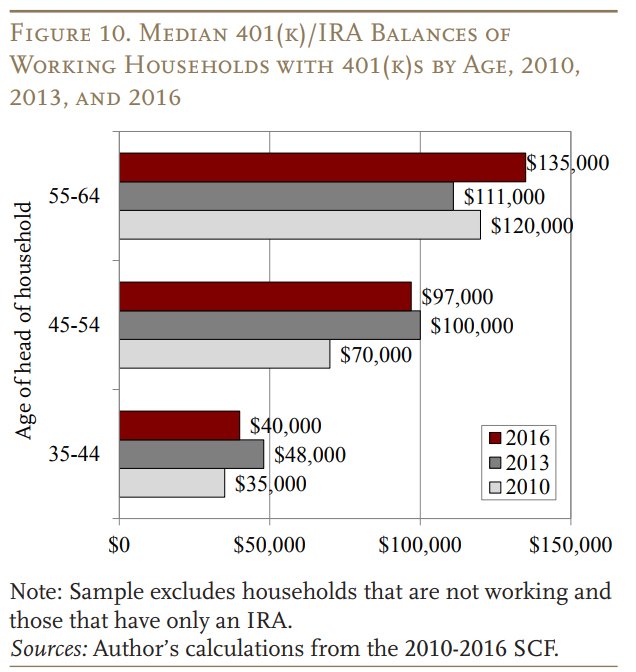

- The Federal Reserve’s 2016 Survey of Consumer Finances offers an opportunity to examine households’ holdings in 401(k)s and IRAs.

- For working households nearing retirement with a 401(k), median combined 401(k)/IRA balances rose from $111,000 in 2013 to $135,000 in 2016.

- While growing balances are encouraging, $135,000 provides only $600 per month in retirement, so current saving levels are still falling short.

- Moreover, about half of households nearing retirement have no 401(k) assets at all, so lack of access to a plan remains an enormous problem.

The key finding for us is the lack of retirement assets for nearly half of those nearing retirement. We find it incredibly disturbing that we have such a significant percentage of our workers headed for government assistance upon retirement. But, is it really surprising?

We have had little wage growth for a majority of U.S. workers for the past two decades, while demanding a greater share of their take-home pay for housing, healthcare, education, etc. There is very little left to allocate to a retirement, especially one that now has to be managed by untrained individuals.

Even a modest DB payout of $1,250/month ($15,000/year) stretched over a 20-year retirement would provide the retiree with a $300,000 payout. That is more than twice what the median 55-64-year-old has at this time in a 401(k)/IRA.

We have people in our industry trying to dismiss the notion that we have a retirement crisis unfoldin. Who are they kidding!