By: Russ Kamp, Managing Director, Ryan ALM, Inc.

We hope that you enjoyed your President’s Day. I remember way back in my grammar school years getting both Lincoln’s (2/12/1809) and Washington’s (2/22/1732) birthdays off from school. However, that fun was squashed in 1971, when the Uniform Holiday Act was passed by Congress, which moved some federal holidays to specific Mondays. Thus “President’s Day” was created as the third Monday in February.

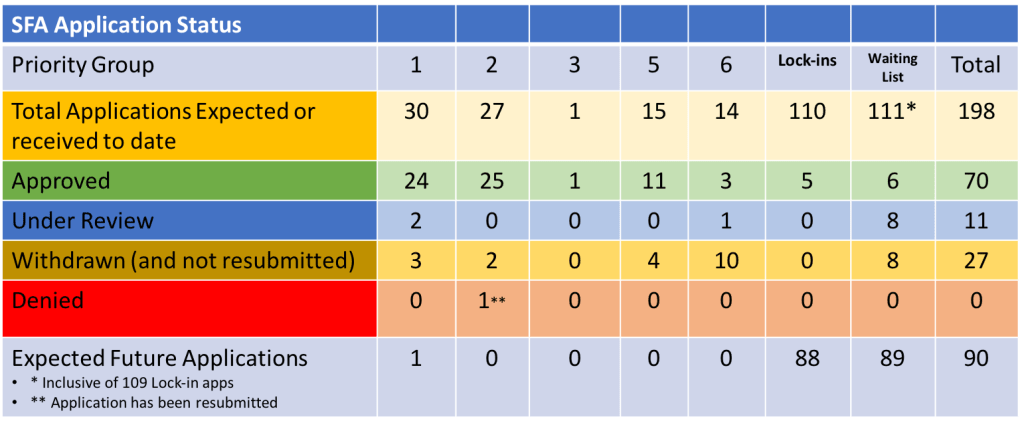

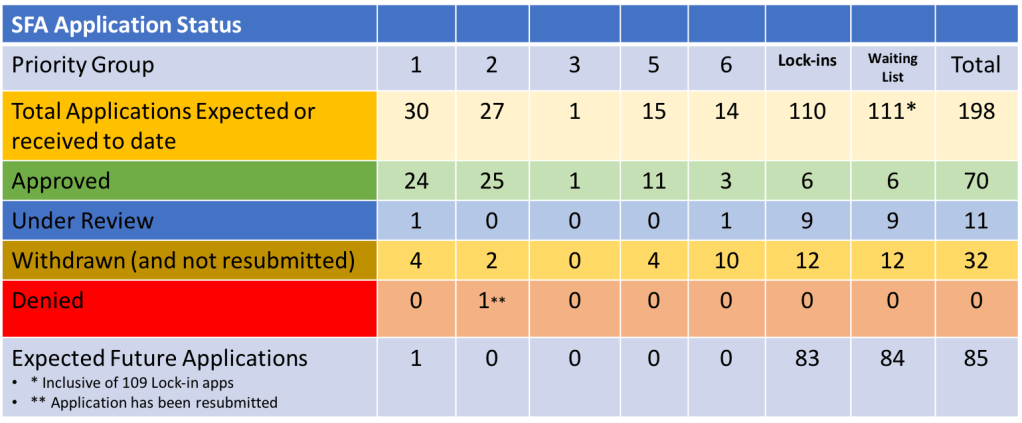

As for the ARPA legislation, the PBGC didn’t quite open the floodgates, but they did allow the application portal to open wide enough to allow four initial applications to be submitted. These plans included, the Carpenters Pension Trust Fund – Detroit & Vicinity, Pension Plan for the Arizona Bricklayers’ Pension Trust Fund, Pension Plan of Local 102, and Maryland Race Track Employees Pension Plan. These funds are all non-priority group members. There have now been 27 plans from the waiting list to see some action in the ARPA process. As a reminder, there are 111 pension funds that were non-priority members.

For those four applications, the plans are seeking a combined $642.7 million in Special Financial Assistance (SFA) for their more than 25k plan participants. In other ARPA happenings, there were no applications approved or denied, and only one plan withdrew its application. The America’s Family Benefit Retirement Plan, a Priority Group 1 member, withdrew the revised application on February 13th. They are seeking $188 million in SFA for 3,109 members. As a reminder, Priority Group 1 members began filing applications in July 2021. Twenty-four of the 30 expected Priority Group 1 members have received approval and SFA funding to date.

US Treasury yields have risen by more than 30+ bps across the yield curve since the beginning of 2024. These elevated yields help reduce the present value (PV) cost of those future benefit payments. Cash flow matching strategies will take advantage of these higher yields and lock-in the savings (cost reduction) as soon as the asset cash flows from bonds (principal and interest) and the liability cash flows (benefits and expenses) are matched.