By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Nasdaq eVestment has published capital market forecasts gathered from 11 leading asset consulting firms. The 2024 capital markets outlooks in their report were gathered across the self-authored documents in Nasdaq eVestment’s “Market Lens” from 11 consulting firms (AON, Callan, Cambridge, Cliffwater, Fiducient Advisors, Meketa, NEPC, RVK, Segal Marco Advisors, Verus, and Wilshire), who presented their findings to public plans. This report specifically focuses on the 10-year nominal, risk and return expectations from these consultants. I don’t mean to spoil that outcome, but the ending isn’t pretty.

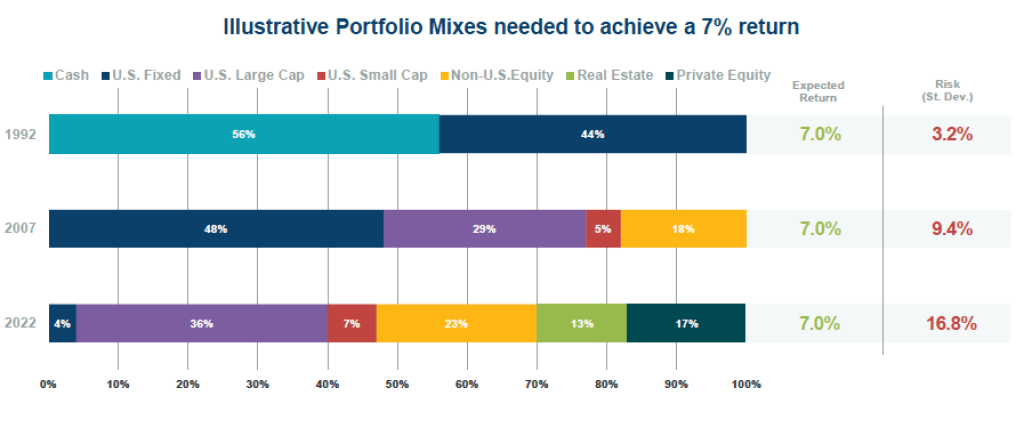

According to this collection of forecasts, inflation is expected to average 2.34% for the next 10 years. US Large Cap (presumably the S&P 500) is only expected to produce a 6.3% annualized return or roughly 4.0% “real”. Worse, that 6.3% return is attached to an estimated 16.9% annual standard deviation. Despite less the stellar results for non-US equities, forecasts are for slight improvement relative to US equities, but only marginally so at 7.04%. However, it is accompanied with 19.2% annual volatility. The existence of a small cap “premium” is being called into question as small cap, which has dramatically underperformed large cap (15.0% (S&P 500) versus 8.9% (R2000)) for the last 5-years through July 31, 2024. That said, this collection of consultants believe that US-small cap can outperform large cap by 13 bps during the next 10-years, but in order to accomplish that feat, annual volatility is predicted to be 21.8% or roughly 5% greater than US-large cap.

With regard to alternatives, which seem to be drawing the most attention and cash flow activity, hedge funds (4.71%), private debt (8.28%), private equity (9.21%), real assets (7.71%), and real estate (6.90%) are also forecast to produce returns below historic norms. Furthermore, outside of hedge funds (6.85%), these forecasted results are accompanied by significant volatility projections. Private equity, the darling of the alternative set is forecast to produce annual volatility of 23.76% around that 9.2% forecasted 10-year result. Is the 9.2% worth the higher fees, lack of liquidity, and minimal transparency?

The darling of these forecasts is related to bonds, which may not have the highest predicted returns, but those forecasted results are achieved with very reasonable annual volatility. For instance, US core portfolios (likely related to the BB Aggregate) are forecast to generate a 4.8% 10-year result with only a 5.1% annual standard deviation. Interesting to note that the 4.8% estimated core fixed income return is 69% of the US – large cap return forecast but comes with only 26% of the annual risk. Furthermore, US short government/credit expectations call for a potential return of 4.28% for only a 2.83% annual variation. We are often asked to defease 1-5 years of a pension plan’s liabilities, which benefits from the attractive return/risk characteristics at the front of the yield curve.

I recently produced a blog post on the evolution of pension asset allocations and the tremendous change in the annual volatility associated with the migration of assets from traditional equity and fixed markets into various alternatives. Given the much higher fixed income returns now available to pension plan sponsors, hopefully asset allocations will once again reflect this reality at much more modest levels of risk.

From the report: “The higher interest rates of the last two years mean that many investors should be able to take on less risk than they have over the past decade if they want to achieve their target returns.” – Meketa

Again, the primary objective in managing a defined benefit plan is to SECURE the promised benefits at a reasonable cost and with prudent risk. It isn’t a return objective, which is a good thing given the 10-year projections cited in this report. Use the attractive fixed income yields to secure benefits (Retired Lives Liability) as far into the future as your fixed income allocation will cover. Not only do you have a dramatically improved liquidity profile, but you’ve just bought significant time for those non-bonds to achieve the forecasted returns, while wading through all that volatility.