By: Russ Kamp, CEO, Ryan ALM, Inc.

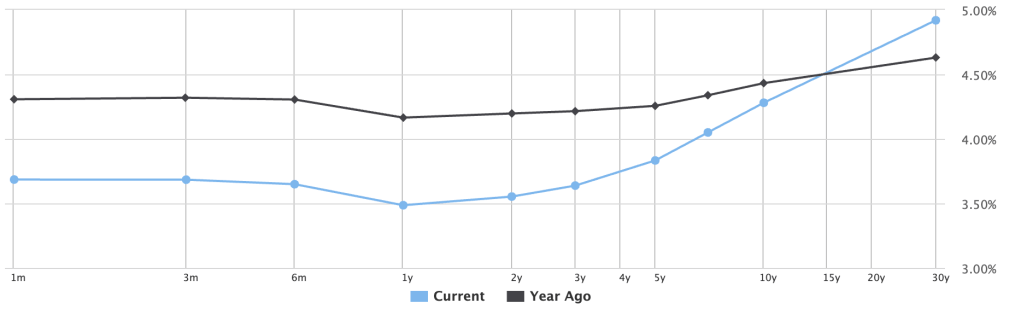

Given today’s headline news related to initial jobless claims and layoffs for January, which were at the highest level since 2009, risk assets are once again selling off (Bitcoin -7% and Nasdaq -1.5%), while short-term Treasury notes are rallying. As a result, the U.S. Treasury yield curve is continuing to steepen, as reflected in the WSJ graph below.

The spread between 2-year notes and 30-year bonds was only 43 bps 12-months ago. The spread today is 1.37%. As we’ve mentioned, bond math is straightforward. The higher the yield (30-year Treasury bonds are 29 bps higher today than last year) and the longer the maturity, the greater the cost reduction in the future value of promised benefits.

Let us produce a free analysis that will highlight the potential cost reduction in those future promises either through a 100% cash flow matching assignment or a vertical slice of a portion of those liabilities. You’ll be positively surprised by the potential cost reduction.