By: Ronald J. Ryan, CFA, Chairman, Ryan ALM, Inc.

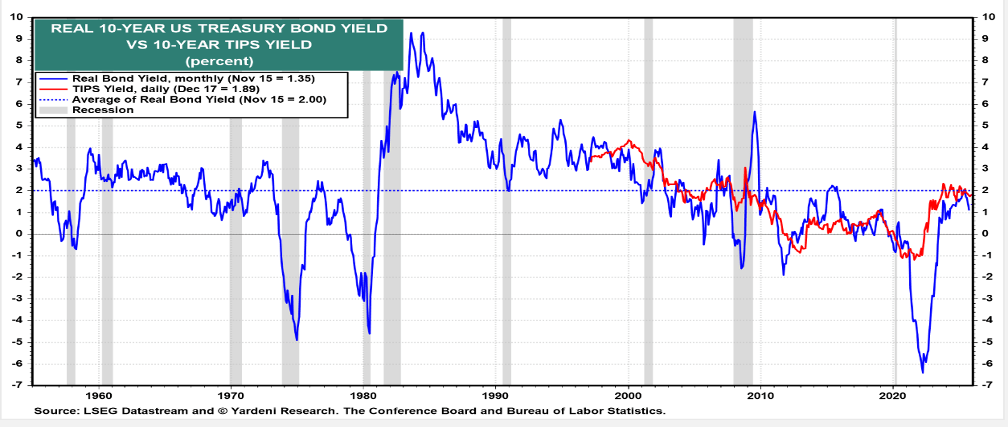

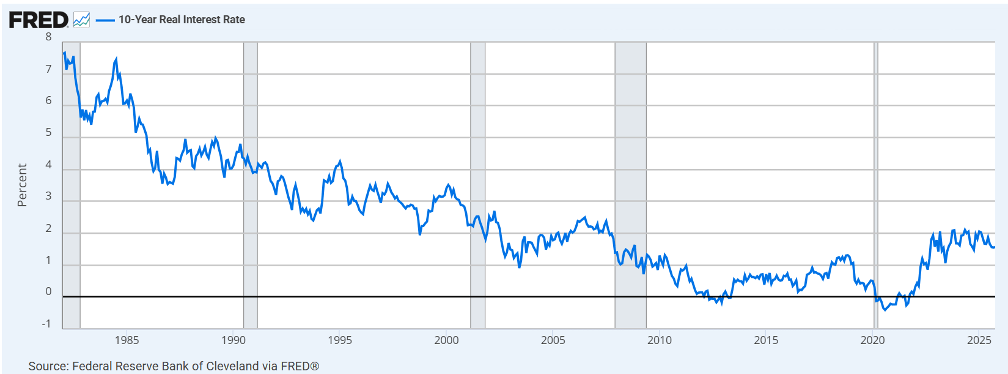

The CPI was released today, and it showed annual inflation at 2.7%, which is much better than the 3.1% estimated. Markets have rejoiced so far with stocks and bonds UP in price and DOWN in yield. But isn’t it real rates (nominal rate – CPI) that are more critical for investors than nominal rates. According to the 70-year study by famed economist Ed Yardeni and the 40-year study by the Fed of St. Louis (FRED)… real rates have averaged 2.0% historically (see graphs). If we add a 2.00% inflation premium to today’s rates, the 10-year Treasury should be yielding about 4.70% instead of 4.17%. Maybe the market is discounting future inflation expectations but until a lower inflation trend line is firmly established, it seems like interest rates should be at least 50 basis points higher.