By: Russ Kamp, CEO, Ryan ALM, Inc.

On Tuesday, I produced a post titled “Bonds Are Not Performance Instruments”. I mentioned that fixed income allocations have been a tremendous drag on pension plans and their ability to hit the ROA target. I also mentioned that bonds should be used solely for the cash flows that they produce (interest and principal at maturity).

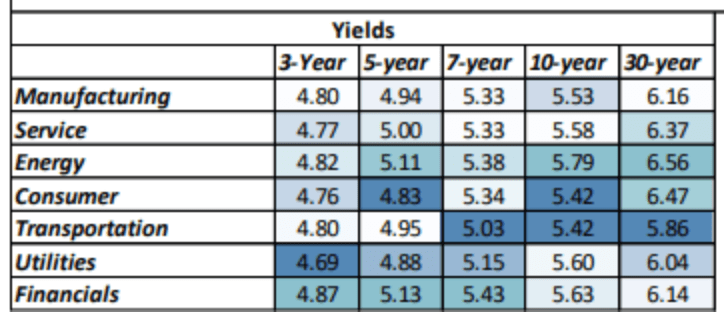

U.S. Treasury yields are marching higher, which will put further pressure on bond performance. However, the elevated yields are providing plan sponsors with a great opportunity to defease the plan’s liabilities through a cash flow matching (CFM) strategy. Look at the yields below for various investment-grade BBB corporate bonds!

As builders of CFM portfolios, we invest in bonds that will produce the greatest cost savings. As a result, we will overweight the portfolio to A and BBB bonds. Given the “average” ROA is roughly 6.75% for public plans, we can capture a significant percentage of the ROA target through 10-year to 30-year bonds depending on the targeted maturity of the client’s CFM mandate. Why would you not want to improve liquidity, secure the benefits, and buy-time for the alpha assets that can now grow unencumbered? Any fund that has the need for regular liquidity should have an allocation to CFM as its core holding.