By: Russ Kamp, CEO, Ryan ALM, Inc.

In some ways it is difficult to believe that we are through 1/3 of 2025, but in other ways it seems like it has been a very long four months.

Regarding ARPA and the PBGC’s implementation of this critical legislation, last week produced modest activity, as reported in the PBGC’s weekly spreadsheet. I’m pleased to report that another two plans, Laborers’ Local No. 91 Pension Plan and Pension Plan of the Asbestos Workers Philadelphia Pension Fund, each submitted revised applications seeking Special Financial Assistance (SFA). These two non-priority group members are hoping to receive a combined $87.3 million in SFA for the 2,057 plan participants.

In other news, fIUE-CWA Pension Plan repaid a small portion of the SFA that it received. The $2.5 million represented <1% of the total SFA received. To date, 50 plans (or roughly 85% of the potential population), have “settled” with the U.S. Treasury on census errors. Another 4 were found not to have received excess SFA. Finally, there are approximately 6 plans yet to come to some conclusion with the Treasury Department.

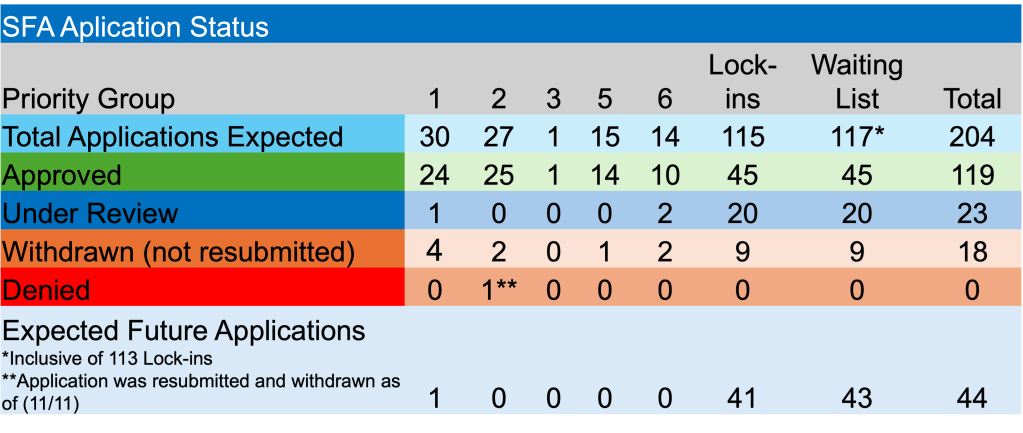

As you can surmise, there were no applications approved or denied, and none withdrawn during the last week. In addition, there were no pension funds seeking to be added to the waitlist. The last entry was in March 2025.

Volatility remains quite rampant within U.S. markets, both equity and bond. For those soon to receive SFA distributions, higher long-term U.S. Treasury rates make cash flow matching an attractive alternative to either active equity or fixed allocations. Please consider securing those promised benefits through a CFM mandate.