By: Russ Kamp, Managing Director, Ryan ALM, Inc.

I very much enjoyed my two days attending the NCPERS conference. Not only did I get the opportunity to share some insights related to cash flow matching (CFM) and the application of this strategy for negative cash flow plans, but I also had the opportunity to listen to wonderful presentations related to a number of relevant topics. The Folks at NCPERS did a terrific job assembling a content rich forum.

One of the presentations that most impressed me was Gene Kalwarski’s. Gene is the CEO for Cheiron, a leading actuarial firm, and someone with whom I had the opportunity to meet through our work on the Butch Lewis Act. He and his firm did an incredible job analyzing 114 multiemployer plans that were thought to be potentially eligible for SFA at that time. At NCPERS, Gene’s presentation was focused on asset allocation for mature plans. He emphasized, and I absolutely agree, that more mature plans need a different asset allocation reflecting, in many cases, different liquidity needs, as they become more cash flow negative.

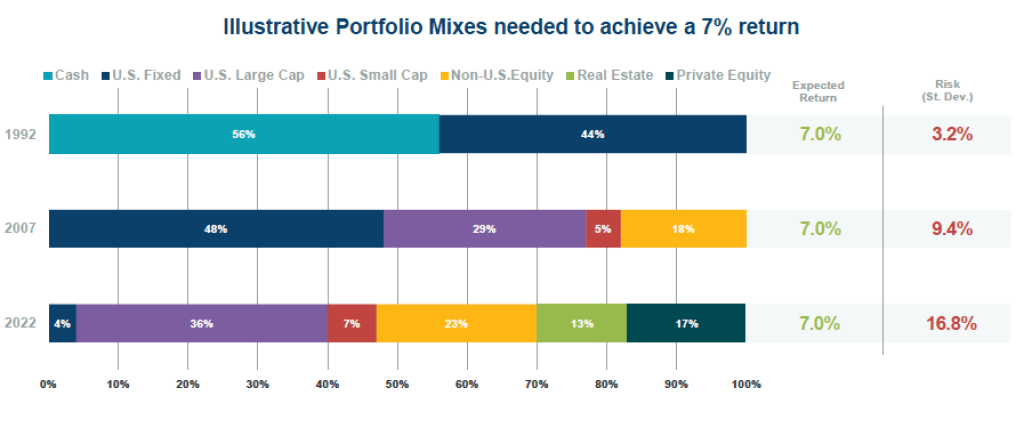

Regrettably, our industry continues to pursue a return focus, no matter how mature a plan may be, by cobbling together plan assets with the ultimate goal of achieving a return on asset (ROA) target. As I’ve written about this subject quite often, that objective hasn’t guaranteed success for the plan sponsor, but it has led to a significant increase in volatility, whether that be the funded ratio or contributions. Just how bad has the volatility of returns become? Gene presented the information in the graph below, which was produced by Callan.

It is incredible to see just how much risk plan sponsors are assuming through today’s asset allocation. Callan estimated that a pension system could strive for 7% in 1992 and would only expect a 1 standard deviation (SD) observation of +/- 3.2%. In other words, 68% of the time, that plan would have expected a return of +3.8% to +10.2%. Rather tame, wouldn’t you agree? By 2007, and just in time for the Great Financial Crisis, that 7% return objective came with a 1 SD observation of +/- 9.4%, meaning that plans should have expected that roughly 2/3rds of the time a result of between -2.4% and + 16.4%. Not great, but not horrible either.

Fast forward to 2022, or just in time for both equities and bonds to suffer meaningful losses, that 7% target now came with a 1 SD observation of +/- 16.8%. Wow! With that risk profile, a plan sponsor should not have been surprised with a return between -9.8% and +23.8%. That’s a far cry from the days when 68% of the observations fell between 3.8% and 10.2%. Unfortunately, that 1 SD observation only measures expectations for 13 out of 20 years. Since we can’t ignore the other 7 years, as much as we might like to, let’s extend the analysis to include 2 SD events or 95% of the observations (19/20 years). In this scenario, today’s asset allocation would create a range of results of -26.6% and +40.6%. That canyon of expectations should be horrifying! Why would any pension professional structure an asset allocation with such a potential dispersion?

In addition to the uncertainty of outcomes, this new asset allocation comes with increased fees, less liquidity, more opaqueness, and greater complexity. What a bargain! So, as many public pension systems mature, they enter the negative cash flow territory, in which liquidity to meet ongoing benefit payments becomes a greater challenge. Yet, these plans have truly hamstrung themselves through the migration of assets into alternatives. According to Callan, that allocation to alternatives is on average at least 30%, if not more depending on private debt usage today.

Given this incredible reality, mature public pension funds must begin to think of a strategy that will reliably provide the necessary liquidity to meet current benefits and expenses, while growing the corpus to close the funding gap that exists for most plans given the fact that Milliman has estimated that the average public pension system is only 80% funded. Cash Flow Matching (CFM) is the answer. Plan’s need to get away from a singular focus on return and begin to create an asset allocation strategy that bifurcates the assets into liquidity and growth buckets. The liquidity bucket will provide all of the necessary funds to meet benefits (and expenses) chronologically through a defeased bond strategy, while the growth bucket (non-bonds) will benefit from the extension of the time horizon. The objective for the growth bucket is future liabilities.

We, at Ryan ALM, Inc., are experts in CFM. We would be pleased to provide you with a free analysis of how CFM could positively impact your plan’s asset allocation, liquidity, transparency, etc. No pension plan sponsor should live in a world in which annual outcomes can be as wide as the Grand Canyon. How do you sleep at night given the current asset allocation frameworks come with a range of results at +/- 33.6% for 2 SD observations?

Pingback: NASDAQ’s eVestment Consultant Capital Markets Outlooks 2024 – Ryan ALM Blog

Pingback: Overbought? – Ryan ALM Blog

Pingback: That’s Not Right! – Ryan ALM Blog

Pingback: Illiquidity is a Risk – Not a Reward! – Ryan ALM Blog