By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Uncertainty related to the Fed and the US economy has begun to impact equity markets during the past couple of weeks. Will the Fed cut rates? Is the US plunging toward a recession? Is the Fed too late? These and many other questions are being asked by the investment community. Expectations for a rate cut in September have become nearly unanimous. As a result, investors have been positioning portfolios in anticipation of future Fed action.

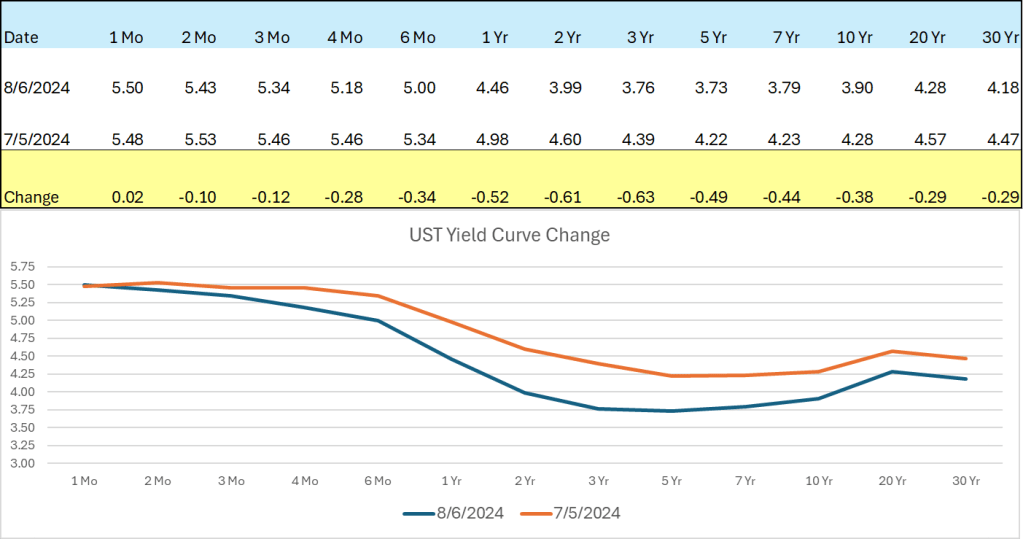

The US bond market has been extremely active with significant flows moving into bonds. In particular, US Treasuries of varying maturities. This has resulted in a significant move down in yields across the yield curve, but primarily in Treasury Notes with maturities 1-5 years, where rates have declined from 49 to 63 bps.

Information provided by Steve DeVito, Ryan ALM’s Head Trader

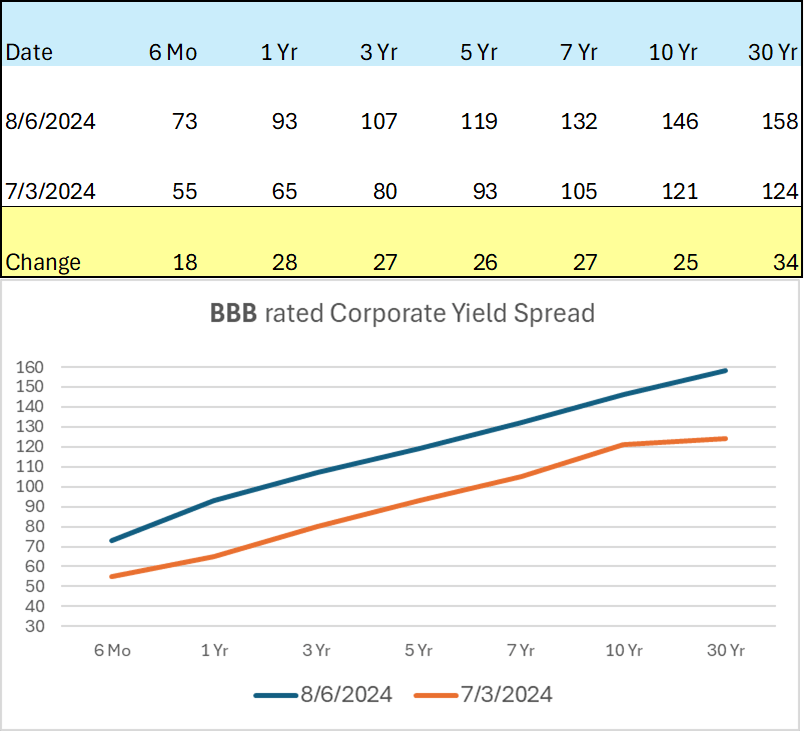

Has this move in rates also been witnessed in investment grade corporate bonds? If so, will the lower yields negatively impact cash flow matching (CFM) portfolios yet to be funded? Lower yielding bonds do reduce the potential cost savings that can be achieved in a CFM mandate, but there is good news on that front. Corporate bond yields, which had been incredibly tight to the equivalent Treasury bond, have widened considerably during the last month. Ryan ALM, Inc. prefers using IG corporate bonds in our CFM portfolios given the higher yields that can be accessed providing our clients with greater funding cost savings.

As the data above reveals, corporate spreads have widened quite a bit relative to Treasuries. For a BBB rated corporate with a 10-year maturity, the current yield spread would be about 146 basis points above the 10-year Treasury or about 5.4% based on today’s market action. That remains a very attractive rate for a pension plan looking to take risk off the table by securing future benefit payments through our defeasement strategy. Fortunately, the widening of yield spreads hasn’t been only found in BBBs, as yields for both A and AA bonds have also expanded relative to the comparable Treasury.

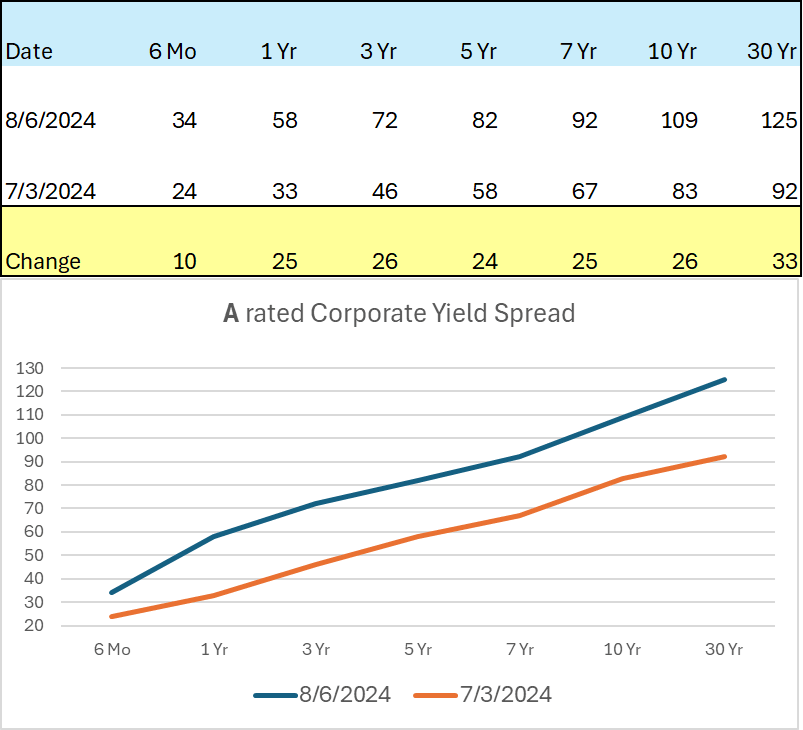

The widening that we’ve witnessed in A-rated corporates is indeed similar to that which has occurred in BBB. So, an A-rated corporate bond would yield about 5.05% today, given the 109 bps spread over the 10-year Treasury. Given the uncertainty in the economy, the capital markets, and with the Fed, why subject 100% of the pension plans assets to a traditional asset allocation framework? Bifurcate your plan’s assets into two buckets – liquidity and growth. The liquidity bucket will use IG corporate bonds with the attractive rates cited above to secure the promised benefits chronologically as far out as the allocation will go. While the liquidity portfolio is being used to make the monthly benefit payments, the remaining assets (non-bonds) will be growing unencumbered, as they are no longer a source of liquidity. Importantly, the liquidity bucket is the bridge that spans all of the potential uncertainty. Growth assets that have an extended investing horizon will see an enhanced probability of meeting their objectives.

Despite the fact that yield spreads have widened, there is no guarantee that those relationships will be maintained. Don’t let market events diminish your opportunity to reduce risk by securing your promises. We’ve witnessed too many occurrences where a delayed response has meant that a wonderful opportunity has been lost. Act today.