By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Yesterday we received the latest update from the Federal Reserves and the message was pretty straightforward. They indicated that they are observing “higher growth and slower deceleration of inflation”. They once again stressed the “possibility” of three rate cuts later this year. But clearly that will depend on how much growth and how slow the path of inflation to their 2% target.

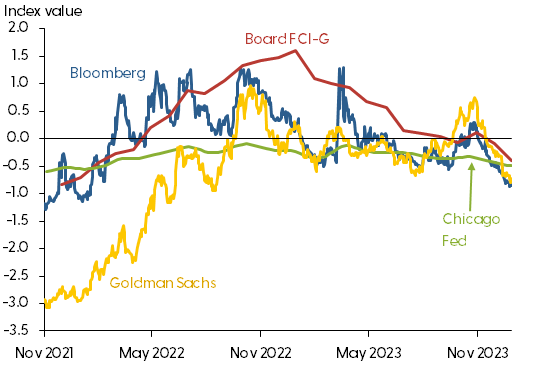

As if on cue, we got two more pieces of economic news today that highlight the economy’s current strength. First, initial jobless claims came in light at 210k versus an expectation of 213k. Despite all of the headlines forecasting major job cuts, IJCs continue to remain at levels that are quite low. In addition, we had the release of existing home sales for February. The investment community had forecasted annual sales of 3.95 million. The reality far outpaced the predictions as annual sales came in at 4.38 million. Clearly, the higher mortgage rates are not keeping folks from purchasing homes despite upward pressure on prices as a result of low inventory. Furthermore, the graph below highlights four indexes that each measure current financial conditions. I’ve referenced the Chicago and Goldman indexes in previous blog posts.

Each of these indexes are showing a similar easing in financial conditions, which makes the Fed’s job more challenging. In some cases, conditions are currently easier than they were at the start of the Fed’s rising interest rate cycle. As we discussed recently, today’s rate environment might be high relative to the Covid-19 era, but they certainly aren’t high by historical standards. This reality is also apparent in the estimates for Q1’24 GDP growth, which continue to forecast >2% growth following a strong 2023.

The Fed should remain diligent in its quest to bring inflation back to target. I lived through the ’70s and witnessed first hand what transpires when the brake on inflation is released too quickly. There are potential shockwaves related to our geopolitical climate that aren’t being factored into the equation to the extent that they should be. Inflation shocks that force the Fed to keep rates higher, if not elevated from this level, could begin to weigh on other markets.

Pingback: Are We Witnessing a Heavy Weight Fight? – Ryan ALM Blog

Pingback: What Are the Stats Telling Us? – Ryan ALM Blog