By: Russ Kamp, Managing Director, Ryan ALM, Inc.

ESG, short for environmental, social, and governance, are considerations alongside financial investment insights used in investment decision making. ESG considerations have been around for a long time, and in most instances, they were prohibitions on the purchase of a particular investment. I recall early in my career a social issue not to invest in South Africa. This was followed by tobacco-free, sin stock-free, and many other imposed limitations on a variety of industries and sectors.

Today, the primary motivation in considering ESG factors is the idea of sustainability. What initiatives should a company take to ensure that their business will not only survive, but thrive, in the future. I’m not going to get into the politics surrounding ESG, but I do agree that sustainability should be a consideration in any investment. However, it shouldn’t be limited to the investment management community. Defined benefit pension plans should operate with the goal of being sustainable. I produced a post many years ago (01/2017) titled, “Perpetual Doesn’t Mean Sustainable“ in which I implored Pension America to rethink the approach to pension management.

Most, if not all, states, cities, and municipalities believe that they are perpetual, and they are correct, but it doesn’t mean that the funding of their public pension fund is sustainable, if the cost to administer the plan becomes onerous for the sponsoring entity. We’ve certainly witnessed the freezing of DB plans within the public sector, and it could continue to happen if changes aren’t adopted. I frequently rail about the traditional approach to asset allocation that has 100% of DB plan asset bases on a rollercoaster ride to reach an ROA target in which they ride markets up and then down only to basically stay in place from a funding standpoint – but contribution expenses certainly don’t!

If plans really want to become sustainable, and we certainly need them to be, they need to adopt as their primary objective the securing of the promises that have been given to their plan participants. Riding the rollercoaster in pursuit of a return objective has only ensured volatility of the funded ratio and contribution expenses. It hasn’t guaranteed success in meeting the objective, which is the securing of the benefits at a reasonable cost and with prudent risk. Why do plan sponsors continue to pursue a return objective and all the volatility surrounding that pursuit when there are strategies that can be used, for at least a portion, if not all, of the assets, that would bring certainty to the process of managing pension plans. A sustainable approach, I might add.

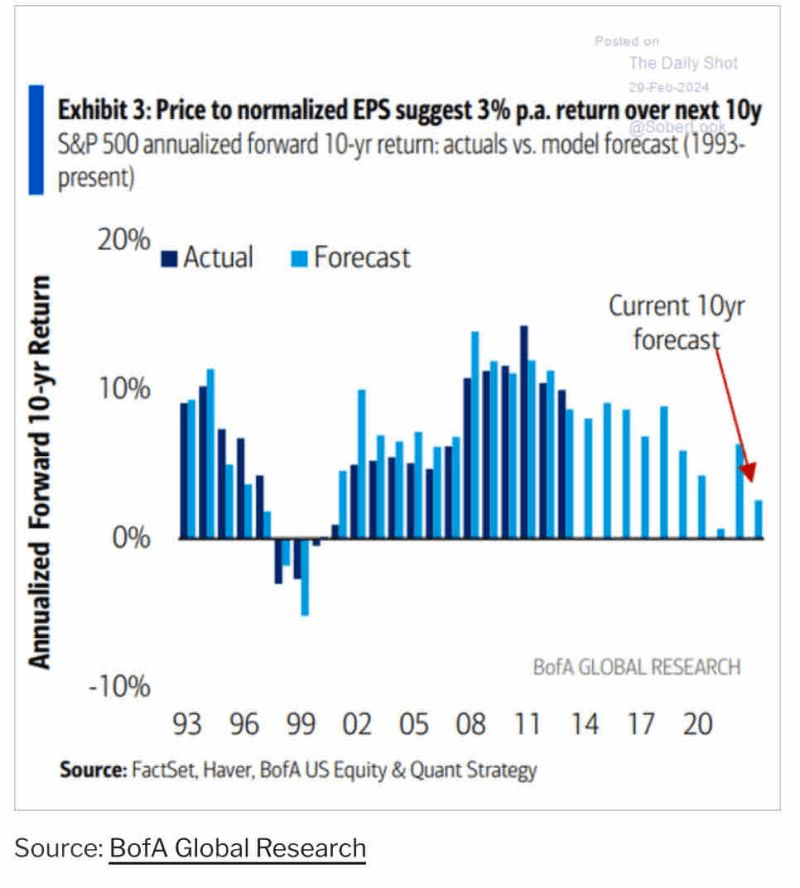

I read a post from a friend of mine yesterday (thanks, Chris), in which he showed a chart from BofA Research that looked at the price to normalized EPS for the S&P 500 over 10-year periods. BofA is forecasting a 3% per annum return for the 10-years ending 2034. Oh, wow! That isn’t going to help pension funding if it is anywhere close to reality. As the chart below suggests, the reality hasn’t been much different from the forecast.

So, what can plan sponsors do to make up for the potential shortfall? There is some great news. If you desire a more attractive return than a potential 3% per annum for the S&P 500, with all of the corresponding annual volatility, you can reallocate your bond exposure from a ROA return focus to a cash flow matching (CFM) mandate that will fund and match the plan’s liability cash flows. By securing the liabilities chronologically, you buy time for the residual (alpha) assets to grow unencumbered as they are no longer a source of liquidity. Importantly, once you match the asset cash flows (interest and principal) with the benefits (and expenses) you mitigate interest rate risk, while working to stabilize the funded status and contribution expenses.

Bringing some certainty to a very uncertain process is the ultimate in sustainability. Given how challenging many American workers are finding the management of a defined contribution offering, protecting and preserving defined benefit plans should be in everyone’s best interest.