By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Having spent more than four decades in the investment pension/industry, I’ve seen more than enough cycles to know that history does repeat. The specifics of the trend/cycle may be different from one event to the next, but the outcomes are normally quite similar. Nothing in our industry stays at equilibrium. Valuations matter and they move from one extreme to another on a fairly continuous basis. We may be nearing a peak once again within the S&P 500’s sector weightings. I’m specifically referring to the weighting of the tech sector (information processing to be more precise).

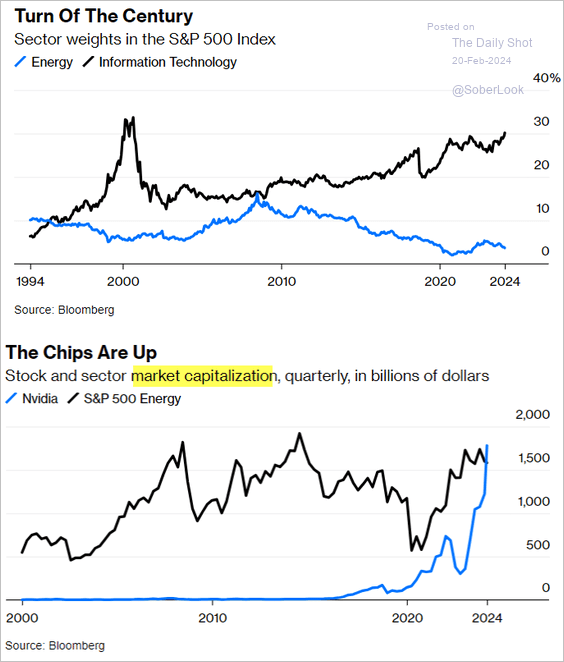

Source: @liamdenning, @opinion

As the above graphs highlight, we are once again witnessing tremendous exposure within the S&P 500 to information processing. The last time that this sector’s weight eclipsed 30% of the index was just before the Tech bubble burst. Again, it is different. Companies within this sector have great businesses and actual earnings but do they have valuations that can justify the current stock prices? Perhaps we’ll find out more this afternoon when Nvidia announces their latest results.

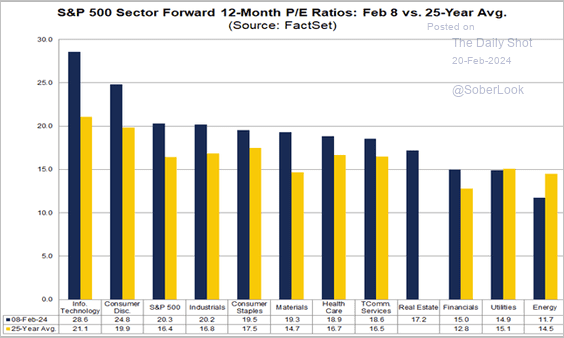

In any case, it seems a bit shocking to me that Nvidia’s capitalization is now greater than that of the entire S&P 500 Energy sector. Furthermore, only Energy and Utilities have a forward P/E multiple that resides below the average for the last 25-years as reflected in this FactSet chart.

We are all taught the importance of buying low and selling high, but most of us get caught up in the excitement of today’s “story” failing to realize that momentum is created by cash flows moving into that theme and that they will eventually peak. It is at that time that Momentum as a factor can reverse quickly. Need we remind you that the NASDAQ 100 declined by 83% from its peak in March of 2000.

The S&P 500 was the place to invest last year. It wasn’t that great the year before (2022). Where will 2024 take us? I wish that I knew. I can tell you that these rollercoaster events are not good for a pension plans funded status or contribution expenses. Adopting a focus on the ROA and not securing the promised benefits has created an asset allocation framework that guarantees volatility, but not necessarily a successful outcome. Securing the pension promise (benefits) at a reasonable cost and with prudent risk does! Why continue to ride the asset allocation rollercoaster for all of the plan’s assets? Given the valuations highlighted above, there doesn’t seem to be a lot of “value” investing in the S&P 500 at this time. Remove some risk and create greater certainty by defeasing a portion of your plan’s liabilities. Not only will you secure those benefits, but you will extend the investing horizon for the remainder of the assets so that they can successfully wade through potentially choppy markets. It is a “win/win”.