By: Russ Kamp, Managing Director, Ryan ALM, Inc.

We, at Ryan ALM, Inc., have been saying “higher for longer” as it pertains to US interest rates. We have been focusing on the strength in the US labor market as the primary reason that a recession wasn’t likely and as a result, the Fed would be cautious in reducing rates. That strength remains a key variable in the recession vs. soft-landing debate, but it isn’t the only signal.

In a surprise, perhaps shock, to market participants, the Institute for Supply Management’s (ISM) services-activity index rose to 53.4 in January from 50.5 in December. Economists had forecast a less robust climb to 52.0. A reading above 50 indicates expansion in the services sector. The recent strength in this index has perhaps caught some folks off guard, as it has recorded 13 consecutive months of growth, and according to the WSJ, 43 of the past 44 months. Wow!

In further support of the soft-landing believers, the ISM’s employment index jumped into expansionary territory coming in with a reading of 50.5 from 43.8 in December. The new orders index ticked up to 55.0 in January from 52.8, while the survey’s measure of business activity held on month at 55.8.

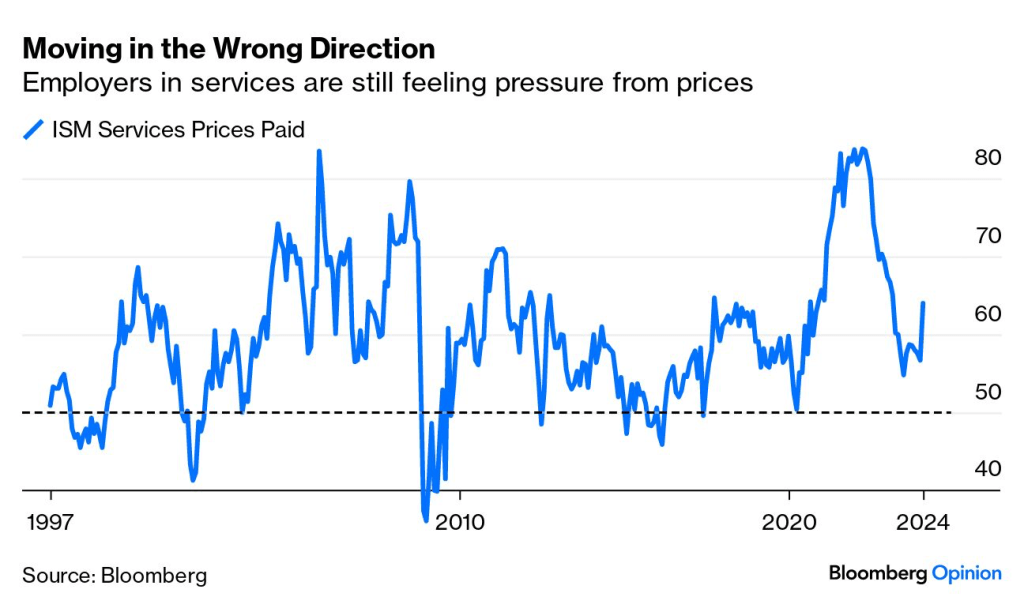

Perhaps the most concerning (for bond investors) reading in this latest report is the index of prices rose 7.3 points to 64.0! The 7.3 increase is the largest monthly increase since August 2012. It is this reading that will likely give pause to policymakers at the Federal Reserve as they contemplate the next move in the interest rate chess match.

With US interest rates likely remaining higher for longer, any investment in high quality bonds should be for their cash flows of principal and interest. Use those asset cash flow to match your pension plan’s liability cash flows of benefit payments and expenses. By matching or defeasing these obligations you are mitigating interest rate risk for those assets, as benefit payments are future values that are not interest rate sensitive. A $1,000 payment in March is $1,000 whether or not rates are at 2% or 10%. Hope of falling rates is not an investment strategy that I’d want to hang my hat on, but cash flow matching is, as it brings certainty to a very uncertain investing environment.