By: Russ Kamp, Managing Director, Ryan ALM, Inc.

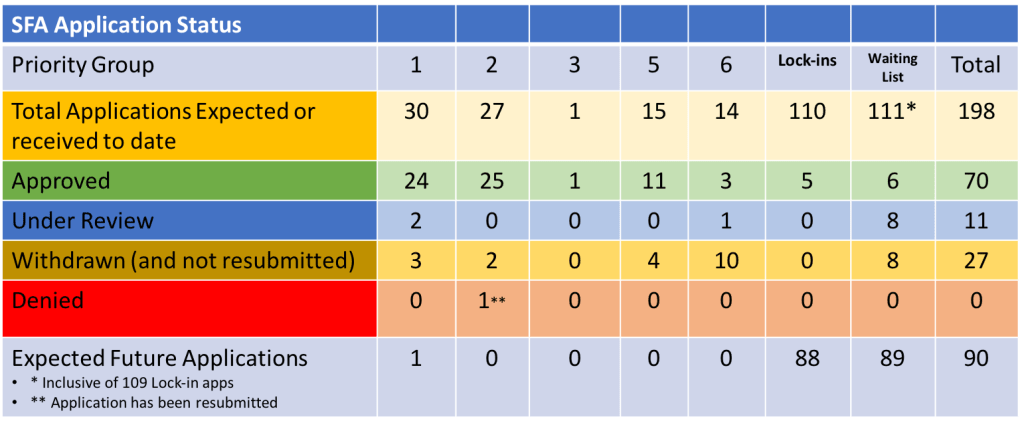

Happy Monday. Here is the latest from the PBGC as they implement the ARPA legislation designed to secure the promises mad by nearly 200 struggling multiemployer plans. The PBGC is still not cranking out the SFA, but we are at least seeing a bit of activity following a prolonged quiet period.

During the most recently completed week, we witnessed one new application submitted. UFCW Regional Pension Fund, a non-priority group member, filed a revised application seeking $51.7 million for its 4,605 plan participants. The PBGC will have 120 days (May 30, 2024) to complete the review. In other news, there were three plans that withdrew applications during the past week. These plans included the Bakery and Confectionery Union and Industry International Pension Fund, a Priority Group 6 member, that pulled its revised application, the CWA/ITU Negotiated Pension Plan, a non-priority group member that withdrew its already revised document, and the Radio, Television and Recording Arts Pension Plan, also a non-priority group member that took back its initial application.

In total, these funds were seeking $3.8 billion in SFA for the nearly 128K plan participants. The majority of these assets would be earmarked for the Bakery and Confectionery plan ($3.2B). Rounding out our weekly update, there were no applications approved or denied and there were no new plans added to the waitlist, which continues to have 111 members, of which 22 applications have gone through at least an initial screen.

There are still roughly 130 plans that will potentially receive SFA grants. Given the plethora of risks to our capital markets at this time, I hope that plans are looking to secure the grant money through cash flow matching, while assuming risk within the legacy portfolio. Again, the purpose of the grant is to secure benefits as far into the future as the allocation can go. It is NOT about taking risk. Use the legacy assets which benefit from an extended investing horizon since they are not a source of liquidity until the SFA has been fully depleted.