By: Russ Kamp, Managing Director, Ryan ALM, Inc.

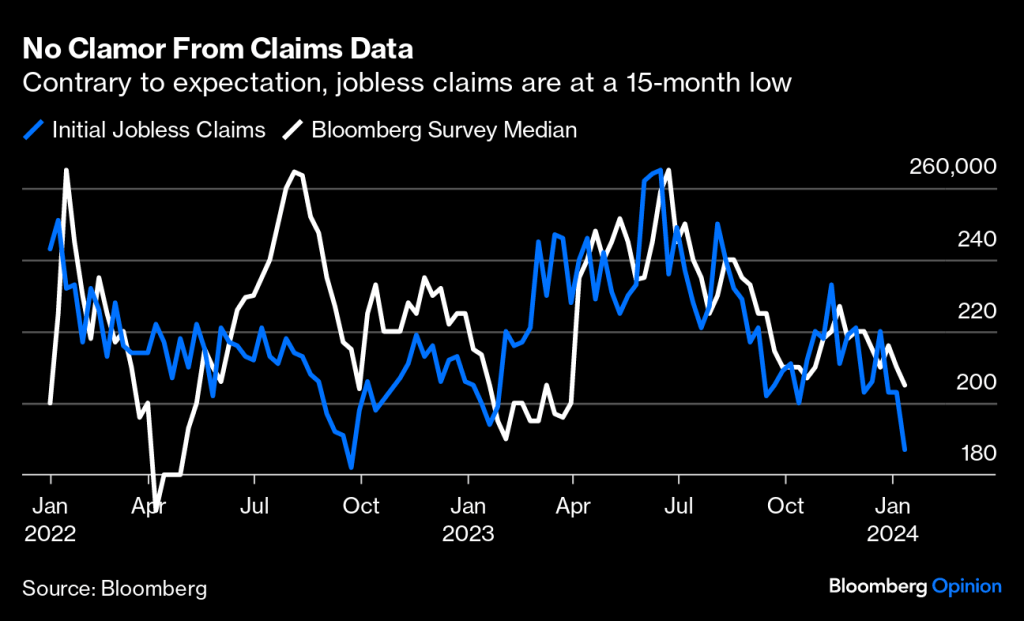

We have stated unequivocally that recessions do not occur when labor markets are at full employment. The expectation that the US Federal Reserve was going to reduce rates 6-7 times in 2024 was a pipe dream. Currently, US initial jobless claims continue to come in at levels last achieved in 2022. In the most recent release (1/18/24) initial claims were at only 187K while expectations were at 208K. As the chart below reveals, initial claims have remained at very modest levels.

The increase in the FFR from 0% to 5.25%-5.50% has had little impact on the US labor market, which continues to show unemployment at only 3.7% and a Labor Participation Rate (LPR) of 62.5% up from the depths following the initial Covid-19 restrictions when the LPR touched 60.8%. When folks are working and earning money, they are spending, as we witnessed in 2023 when the consumer carried the economy forward. They also tend to feel better about the economy as a whole. Today’s University of Michigan Survey of Consumers – preliminary data came it a 78.8 when it was expected to register at 70.2 certainly supports those enhanced expectations.

According to the Atlanta Fed’s GDPNow model, GDP growth for Q4’23 is estimated at 2.4%. Again, what recession? Why would the Fed be compelled to reduce rates in an environment of full employment and economic growth? The expectation of a looming recession drove investors into bonds during the 2022’s fourth quarter. As a result, Treasury yields collapsed from levels at or above 5% to in many cases below 4%. The extraordinary move certainly eased financial restrictions and brought Treasury yields to a level that seemed to be overbought. We wrote several posts related to the investing community getting ahead of themselves in the process.

Since the end of 2022, Treasury yields have once again climbed and the expectations for aggressive Fed easing have waned. What was once considered a slam dunk that the Fed would cut the FFR by 25 bps in March now has only a slightly > 50% of that occurring, and I think that those odds should be much lower.

There is good news for pension plan sponsors in this data. Higher interest rates help in two meaningful ways. First, higher rates reduce the present value (PV) of those future benefit payments. As a result, the asset side of the equation doesn’t have to work as hard. What really killed pensions in the private sector was the significant decline in US rates from 1982 to 2022, as the cost of pension promises went through the roof. Second, higher rates mean that bond yields can get you close to your ROA with far greater certainty and less volatility than investing in equities and alternatives. In addition, those bond cash flows of interest and principal provide the plan with the necessary liquidity to meet the monthly payments at lower costs.

Lower US interest rates certainly propped up risk assets during the last 4 decades, but in the process they truly harmed pension America as more and more risk needed to be injected into the asset allocation process. The subsequent rollercoaster ride of markets up and then down negatively impacted pension plan contributions and funded status since 1999. As I’ve stated before, humans hate uncertainty, yet traditional asset allocation frameworks bring with them great uncertainty. It is time to increase your allocation to bonds. Capture the greater yield currently available. In fact, defease those pension promises by matching bond cash flows to liability cash flows. You’ll sleep so much better and so will your plan participants!