By: Ronald J. Ryan, CEO, Ryan ALM, Inc.

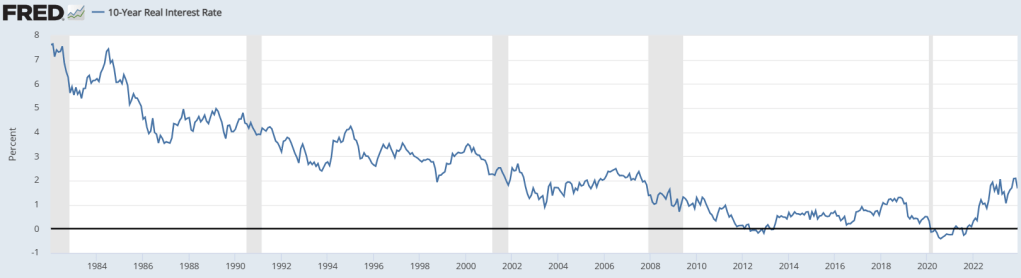

Chairman Powell and the Fed have been steadfast in their stated goal of 2.0% inflation as measured by Personal Consumption Expenditures (PCE). The November PCE was announced today at 2.6% YoY. The Fed also has consistently expressed a goal of real rates or the inflation premium. The Fed has not announced a target real rate but the historical average is about 3%, as suggested in the chart below.

Indeed, most pensions have an inflation premium built into their plan’s projections of about 3%. But let’s assume that 2% is an acceptable Fed real rate target. That would suggest nominal rates of about 4.6% on the 10-year Treasury. Currently, the 10-year Treasury is at 3.86%. As Russ suggested in a blog post from earlier this week, has the investing community gotten ahead of themselves? If PCE inflation went to 2%, a real rate of 2% would suggest a 4.0% nominal 10-year Treasury, which would be slightly above where the market is today. This reality would not suggest interest rates should trend lower in 2024.

The question remains… where will inflation (as measured by the PCE) level off? Who knows… there are too many factors to consider. With durable goods coming in at 5.4% increase for November, two wars being financed and an election year looming, it is hard to suggest a recession is forthcoming. But why speculate on interest rates. With interest rates so much higher than they were in the last 10 years, why not defease Retired Lives? The value in bonds has always been in the certainty of their cash flows. Use bonds for their value and defease the most certain liability cash flows (Retired Lives). The Ryan ALM cash flow matching model (Liability Beta Portfolio™) can reduce funding costs by about 2% per year (1-10 years = 20%).