By: Russ Kamp, Managing Director, Ryan ALM, Inc.

I am preparing for a session that I will conduct in late January for the FPPTA. I’ve been asked to speak about US equity indexes, which I’ve done before despite my current role at Ryan ALM, Inc. It is a fun topic and I’ve evolved it over the years to use index performance as a predictor of future relative performance. As most everyone in our industry appreciates, we have two primary equity cycles involving Growth and Value and Large cap and Small cap. The style cycles are driven by economic conditions, but often exacerbated by fund flows. We do have a tendency in our industry to overwhelm ideas and opportunities through massive asset movements.

I’ve written a bit recently on the current state of domestic US equity. Where large cap growth and the S&P 500 are significantly outperforming small cap value, as the “Magnificent Seven (M7)” large cap tech companies become an ever-bigger percentage and influence within these two cap weighted indexes. Currently, the M7 are >30% of the S&P 500 and have a combined market cap that is greater than the UK, France, Japan, and China! The question that everyone should be asking is if this level of concentration and superior performance is sustainable?

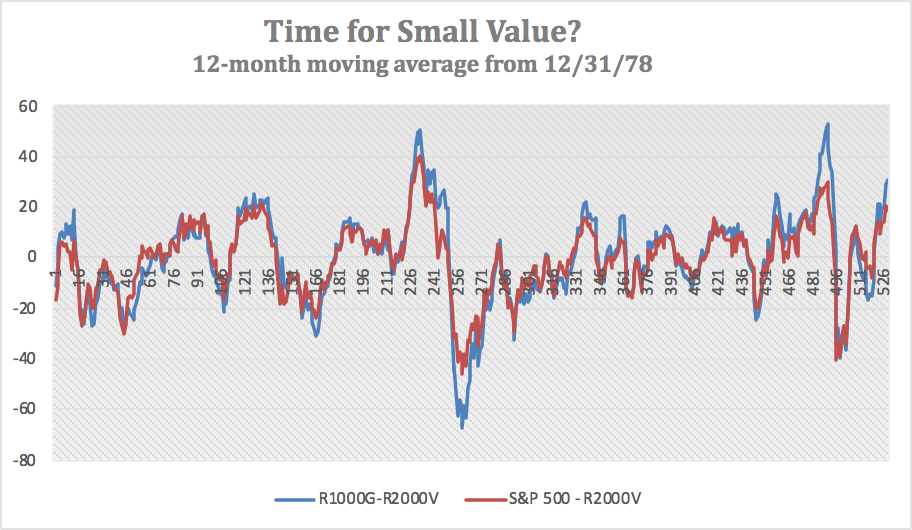

As my graph above highlights, we’ve witnessed boom and bust cycles for both Large Growth (R1000G) and the S&P 500 before. Both experienced superior outperformance versus Small Cap Value (using the R1000V index) at periods ending March 1999 and September 2020. The gradual climb to those peaks took years, but the reversal was incredibly swift. Once the momentum was wrung out of those stocks the relative performance reversal came on like a bullet train.

In fact, it only took 19 months from the peak achieved by Large Growth vs. Small Value (relative outperformance for 12-months of 50.14%) to have that relative performance erased. It only took another nine months for Small Value to have outperformed Large Growth by an incredible 66.98% over the previous 12 months. This pattern was once again on display and magnified by Covid-19. For the 12 months ending February 2019, LG had outperformed LV by 2.2%, while the S&P 500 had only beaten the SV index by 0.26%. During the next 19 months, and fueled by the Pandemic, these two indexes outperformed by 50.41% and 30.03%, respectively.

But investors shouldn’t have gotten complacent, for within 6 months of reaching peak relative performance, Small Value would outperform Large Growth by 34.3% and the S&P 500 by more than 40% as of March 2021. Oh, my. The relative performance reversal was incredibly swift and relentless.

Where are we today? As I stated earlier, Large Growth and the S&P 500 have both dramatically outperformed Small Value by 30.9% and 18.57% through November 30, 2023 on a 12-month trailing basis. We aren’t near previous peaks achieved in the past, but the outperformance is certainly meaningful. What will be the catalyst that reverses the current trend? Will it be the fact that the economy is actually performing better than expected and we are not likely to see a significant recession? I’m not smart enough nor is my crystal ball any clearer than yours, but I would suggest that taking profits off the table from Large Cap growth and the S&P 500 and redeploying those assets into Small Cap Value is likely to reward pension plan sponsors during the next equity cycle or get really radical and take domestic equity profits and use the proceeds to defease your Retired Lives Liability (RLL) chronologically from next month as far into the future as that allocation will go.