By: Russ Kamp, Managing Director, Ryan ALM, Inc.

It wasn’t two months ago that Treasury yields were approaching or had breached 5% across the yield curve. Today, those yields are just above or below 4% for maturities 3-years and out. What changed? Clearly, the Fed’s messaging has indicated to the investment community a sea change related to future interest rate moves. But what has changed from an economic perspective to warrant such a dramatic move? US employment remains near historic levels. Labor participation rates are growing. Wages are increasing at a decent rate. The US economy continues to outperform expectations. Core inflation remains elevated at nearly 2X the Fed’s 2% target. Where is the long-anticipated recession? Oh, and by the way, housing starts blew away expectations today at 1.56 million units when 1.36 million were anticipated. This is the most activity since May 2023, and the lower mortgage rates (7.34% from the peak at 8.28%) might just continue to thrust housing forward.

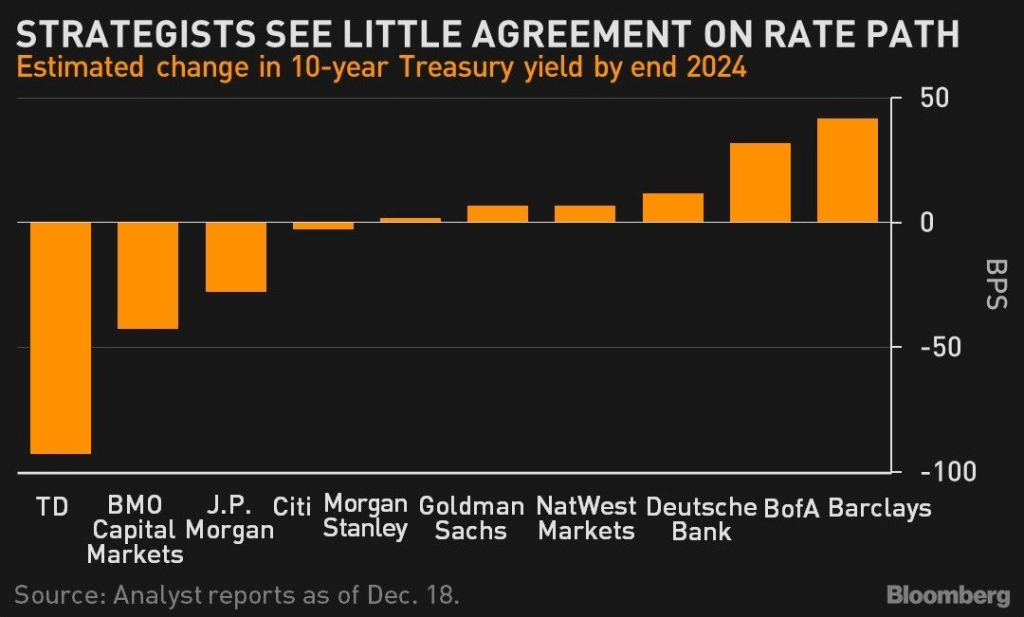

Was the reaction to the Fed’s third consecutive meeting pause an overreaction? Is the expectation among investors that the Fed’s next move must be to reduce rates a reflection of living with 40-years of Fed easing anytime that there was a wobble in the investing world? Has the potential Fed easing in 2024 been fully priced in already and what might that mean for bond investors as we go through 2024 and beyond? Are you confused yet? Well, that isn’t surprising since most of us have never been through a protracted secular interest rate rise such as the one experienced from 1953 to early 1982. Well, as the chart below highlights, you aren’t the only one who is uncertain as to where US interest rates might be at the end of 2024. Thanks to the following Bloomberg chart that my college Steve DeVito (Ryan ALM’s Head trader) grabbed from LinkedIn.com, it seems like strategists on Wall Street are also at odds with one another as to where rates are going.

I suspect that if this chart had been produced at the end of October 2023, there might be greater unanimity as to the future direction of rates given that the 10-year Treasury yield was at nearly 5% at that time. At 3.89% (10:24 am EST on 12/29) there is far greater uncertainty. Again, given the economic backdrop, why should the 10-year be trading at a negative real yield to US core inflation?

There is some speculation in the market that the significant rally in bonds was partially fueled by hedge funds unwinding their short future positions, which had been significant since the Fed began raising rates. I think that there is some merit in that opinion despite not having position reports to support that thought. It just doesn’t seem that the current economic environment would support such a robust drop in rates just because the Fed refused to elevate rates for the third consecutive meeting.

Given the uncertainty in today’s market, why make an interest rate bet? Being long fixed income benchmarked to the BB Aggregate Index is an interest rate bet. The plan sponsor and their consultant believe that at worst rates will remain at this level in which the manager will capture the yield of the portfolio. If rates were to fall there might be some appreciation (on paper at least) to go along with the interest. However, if the market has moved to quickly and created in the process an overbought US bond market (at least Treasuries) the possibility of capital depreciation exists should rates reflect the current environment and not some future state that might not be achieved.

Take this opportunity of higher rates and use corporate bonds to defease your plan’s Retired Lives Liability (RLL) chronologically as far into the future as your bond allocation will cover. Given that benefit payments are future value promises they are not interest rate sensitive. No guessing or hoping needed. The cost reduction to defease the plan’s liabilities is locked in on day one of the strategy being deployed. How comforting would it be to know that no matter what transpires in the capital markets your plan participants will receive their promised benefits. It is very easily arranged and quite cost effective. Give your DB plan participants a Christmas present by defeasing your liabilities while reducing funding costs with certainty.

Pingback: Will The Fed Get Real – Ryan ALM Blog

Pingback: Did The Investing Community Get too Far Ahead of the Fed? – Continued – Ryan ALM Blog